Overview: VA loans are a powerful financial tool designed specifically for veterans, active-duty service members, and their families, offering an opportunity to purchase a home with favorable terms and often with no down payment. Backed the U.S. Department of Veterans Affairs (VA), these loans provide a significant advantage, allowing eligible borrowers to secure home financing without the stringent requirements associated with conventional mortgages. How VA loans work is essential for any veteran or service member looking to navigate the home buying process successfully.

How VA Loans Work: VA loans function similarly to other types of home loans, but with key differences that make them more accessible and beneficial to those who qualify. The VA does not issue the loans directly. Instead, they guarantee a portion of the loan, which reduces the risk for lenders and allows them to offer better terms, lower interest rates and the elimination of private mortgage insurance (PMI). This guarantee often makes it easier for veterans to qualify for a loan, even if they have less-than-perfect credit or are unable to make a significant down payment.

Most attractive feature of VA loans is the no down payment requirement, which means eligible borrowers can finance 100% of the home’s value, subject to VA loan limits. VA loans often come with more lenient credit requirements and lower closing costs compared to conventional loans. To qualify, borrowers must meet certain service eligibility criteria and obtain a Certificate of Eligibility (COE) from the VA, which confirms their entitlement to the loan benefits.

- Veterans Affairs loans

- VA mortgage benefits

- home financing for veterans

- zero down payment mortgage

- government-backed loans

- military home loan

- VA home loan requirements

- mortgage insurance

- VA loan eligibility

Who is eligible for a VA loan?

To be eligible for a VA loan, you must meet specific service requirements set the Department of Veterans Affairs (VA). these include:

- Service Requirements: Veterans, active-duty service members, and certain members of the National Guard and Reserves are eligible for a VA loan. You must have served at least 90 consecutive days of active service during wartime, or 181 days during peacetime, you may be eligible if you have completed at least six years of service in the National Guard or Reserves, or if you were discharged due to a service-connected disability.

- Spouses of Veterans: Surviving spouses of veterans who died in service or due to a service-related disability may also be eligible for a VA loan. The surviving spouse must obtain a Certificate of Eligibility (COE) to confirm their eligibility.

- Additional Requirements: Beyond service-related criteria, eligibility for a VA loan also depends on your ability to meet the lender’s credit and income requirements, which often include having a steady income and a satisfactory credit score.

What are the VA loan limits for 2024?

VA loan limits have increased in 2024 to accommodate rising home prices. In most U.S. counties, the standard loan limit is set at $766,550. In high-cost areas, the limit can go up to $1,149,825 for single-family homes. These limits apply only to borrowers who do not have full entitlement, which means they have used their VA loan benefits before. For those with full entitlement, there is no cap on the loan amount, and they can borrow as much as the lender is willing to approve without a down payment.

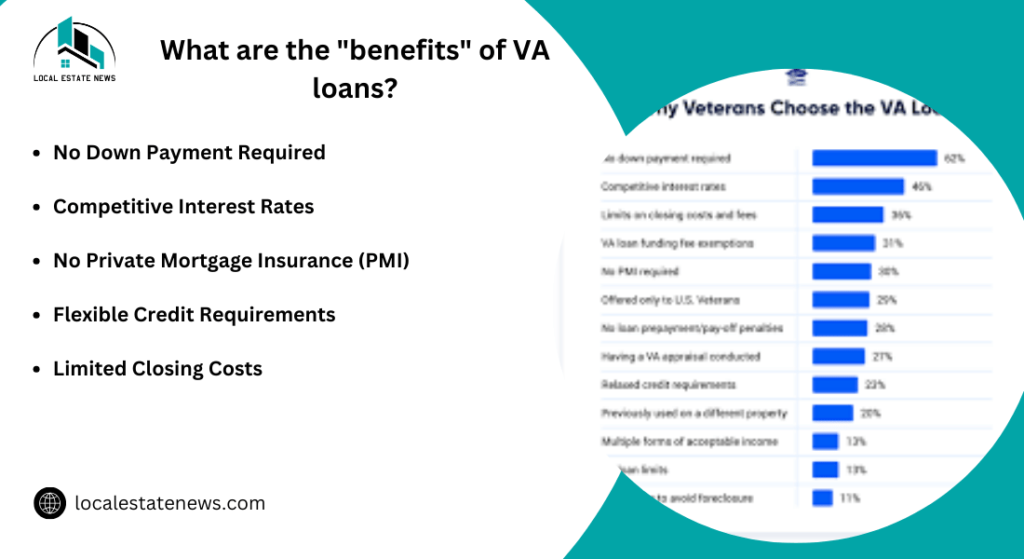

What are the benefits of VA loans?

VA loans offer several significant benefits, making them an attractive option for eligible borrowers:

- No Down Payment Required: The most appealing aspect of VA loans is that they require no down payment, allowing you to finance 100% of the home’s purchase price without needing to save up a large sum of money.

- No Private Mortgage Insurance (PMI): Unlike conventional loans, VA loans do not require private mortgage insurance, even with a low or no down payment. This can save borrowers a significant amount of money over the life of the loan.

- Competitive Interest Rates: VA loans generally offer lower interest rates compared to conventional loans, thanks to the VA guarantee, which reduces the risk for lenders.

These benefits, along with flexible credit requirements and favorable terms, make VA loans an excellent option for veterans and service members looking to purchase or refinance a home.

How do you apply for a VA loan?

Applying for a VA loan involves a series of steps designed to verify your eligibility and ensure that you qualify for the loan based on your financial situation. The process begins with obtaining a Certificate of Eligibility (COE), which confirms your entitlement to VA loan benefits. You can request your COE online through the VA’s eBenefits portal, by mail, or directly through your lender, who can usually retrieve it in just a few minutes. This certificate is crucial because it verifies that you meet the military service requirements to qualify for a VA loan.

You have your COE, the next step is to find a VA-approved lender and get pre-approved for a loan. During this phase, the lender will assess your credit, income, and employment history to determine how much you can borrow. Getting pre-approved not only gives you a clear picture of your budget but also strengthens your offer when you find a home. After pre-approval, you can start shopping for a home that meets VA standards.

After you have selected a property and made an offer, your lender will proceed with the underwriting process, which includes ordering a VA appraisal to ensure the property meets the VA’s Minimum Property Requirements (MPRs). If the appraisal is satisfactory and all other conditions are met, the lender will issue a “clear to close,” and you will proceed to the closing process where you will finalize your loan and take ownership of your new home.

What credit score is required for a VA loan?

The key advantages of VA loans are their more flexible credit requirements compared to conventional loans. While the VA itself does not set a minimum credit score, most lenders look for a credit score of at least 620 to qualify for a VA loan. Some lenders may accept lower scores, depending on other factors, your debt-to-income ratio, employment history, and overall financial profile. This flexibility makes VA loans an attractive option for veterans and service members who may not have perfect credit.

What are the VA loan occupancy requirements?

VA loans have specific occupancy requirements that borrowers must meet. The primary condition is that the property being financed must be used as your primary residence. This means that you must occupy the home within a reasonable time frame after closing within 60 days. There are exceptions to this rule, if you are deployed, in which case your spouse can fulfill the occupancy requirement. you must intend to live in the home as your primary residence for at least one year, although there is no requirement to keep the home as your primary residence indefinitely

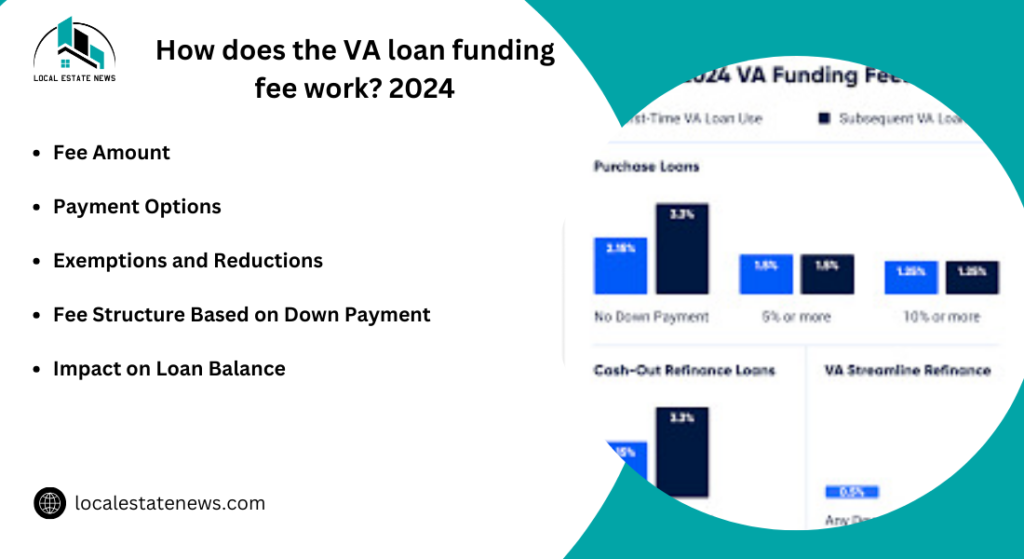

How does the VA loan funding fee work?

The VA loan funding fee is a one-time payment required, most borrowers using a VA loan. This fee helps offset the costs of the VA loan program and reduces the financial burden on U.S. taxpayers. The amount of the funding fee is calculated as a percentage of the total loan amount and varies depending on several factors, including whether it’s your first time using a VA loan and the size of your down payment.

For first-time VA loan users, the funding fee is 2.15% of the loan amount with a down payment of less than 5%. This fee decreases to 1.5% if you make a down payment between 5% and 9.9%, and further decreases to 1.25% if your down payment is 10% or more. If you’re using a VA loan for the second time or more, the funding fee increases to 3.3% if your down payment is less than 5% but remains lower if your down payment is larger.

You can choose to pay the funding fee upfront at closing or finance it over the life of the loan rolling it into your mortgage. While financing the fee might be easier on your pocket initially, it will increase your overall loan amount and the interest paid over time. It’s important to consider both options carefully when deciding how to manage this cost.

What is the VA loan Certificate of Eligibility (COE) and how do you obtain it?

The VA loan Certificate of Eligibility (COE) is a crucial document that verifies your eligibility for a VA loan. To obtain a COE, you need to provide proof of your military service, which can be done through various methods depending on your current status. For veterans, this involves submitting your DD Form 214, which details your service history and the nature of your discharge. Active-duty service members can obtain a COE using their Statement of Service, while members of the National Guard and Reserves need to provide specific service records.

You can request the COE online through the VA’s eBenefits portal, by mail, or directly through your lender, who can often obtain it for you quickly. Having a COE is necessary before you can secure a VA loan, as it confirms to lenders that you are eligible for the benefits offered the VA loan program.

What are the common myths about VA loans?

Several myths about VA loans persist, potentially deterring eligible veterans from taking advantage of this benefit. One common misconception is that VA loans are slow and cumbersome, making it difficult to close on a home in a competitive market. In reality, VA loans often close just as quickly as conventional loans, especially when working with a lender experienced in VA financing.

The myth is that you can only use a VA loan once. In truth, veterans and service members can use their VA loan benefits multiple times, as long as they meet the necessary eligibility criteria each time, some believe that VA loans are only for first-time homebuyers, but they are actually available to all eligible veterans, regardless of whether they’ve owned a home before.

Can you use a VA loan for refinancing?

Yes, VA loans offer several refinancing options tailored to the needs of veterans, active-duty service members, and their families. The two primary refinancing options are the Interest Rate Reduction Refinance Loan (IRRRL) and the VA Cash-Out Refinance.

- Interest Rate Reduction Refinance Loan (IRRRL): Also known as the VA streamline refinance, the IRRRL is designed to help veterans reduce their mortgage interest rate or switch from an adjustable-rate mortgage (ARM) to a fixed-rate mortgage. One of the key benefits of the IRRRL is its simplicity—often, no appraisal or credit underwriting is required, making the process quicker and less expensive. The IRRRL is only available to borrowers who already have a VA loan and are looking to refinance that loan to achieve more favorable terms.

- VA Cash-Out Refinance: This option allows veterans to refinance their existing mortgage—whether it is a VA loan or a non-VA loan—into a new VA loan and take out cash from their home equity. The VA Cash-Out Refinance can be used to access up to 100% of the home’s appraised value, providing flexibility for major expenses, home improvements, debt consolidation, or educational costs. However, this option requires a full appraisal and credit underwriting, and it must be used for the borrowers primary residence.

How does a VA loan differ from other mortgage options?

VA loans are distinct from other mortgage options in several ways, making them particularly advantageous for eligible veterans and service members, most significant difference is that VA loans do not require a down payment, which can greatly reduce the upfront costs of purchasing a home, VA loans do not require private mortgage insurance (PMI), which is mandatory for conventional loans with a down payment of less than 20%. This lack of PMI can lead to substantial savings over the life of the loan.

A key difference is the VA funding fee, a one-time fee required to help offset the program’s costs. While conventional loans may have lower upfront fees, they often lack the favorable terms and protections that VA loans offer, more lenient credit requirements and the ability to refinance easily through options like the IRRRL.

What are the closing costs associated with VA loans?

Closing costs for VA loans range from 2% to 5% of the loan amount, which can include various fees, the VA funding fee, appraisal costs, credit report fees, title insurance, and more. The VA funding fee is a significant component of these costs, with the amount depending on factors, the loan type, whether it is the borrowers first VA loan, and the size of the down payment. For example, the funding fee for an IRRRL is 0.5% of the loan amount, while it can range from 2.15% to 3.6% for a VA Cash-Out Refinance, depending on whether it is the first use of the VA loan benefit or a subsequent use.

What happens if a VA appraisal comes in low?

If a VA appraisal comes in lower than the agreed-upon purchase price, it can present several challenges, but there are ways to address the situation. When the appraisal is lower than expected, the lender cannot approve a loan amount higher than the appraised value. This difference, known as the “appraisal gap,” needs to be resolved for the transaction to proceed.

One option is to negotiate with the seller to lower the purchase price to match the appraised value. This is often the first step, as it allows the deal to continue without requiring additional funds from the buyer. If the seller is unwilling to reduce the price, you could consider covering the difference in cash. This option, while requiring an out-of-pocket expense, may allow you to proceed with the purchase if you have the financial means to do so.

If negotiations and paying the difference are not viable, you can request a Reconsideration of Value (ROV) from the VA. This process involves submitting additional evidence, more recent comparable sales data, to challenge the original appraisal. If the VA agrees with your evidence, they may adjust the appraisal value. If all these efforts fail, and the seller is not flexible, you may need to walk away from the deal to avoid overpaying for the property.

How can you get maximize your VA loan benefits?

Maximizing your VA loan benefits starts with understanding all the advantages and how to leverage them effectively, VA loans offer no down payment requirements and no private mortgage insurance (PMI), which can save you thousands over the life of the loan. It is essential to work with a lender experienced in VA loans to ensure you get the best possible terms.

You should regularly monitor your eligibility for VA loan refinancing options, the Interest Rate Reduction Refinance Loan (IRRRL), which can lower your interest rate without the need for a full credit check or appraisal. This can be particularly beneficial if interest rates drop after you secure your initial loan.

Stay informed about your Certificate of Eligibility (COE) status and any changes in VA loan limits, as these can impact your buying power and the types of properties you can afford. Staying proactive and informed, you can make the most of the unique benefits that VA loans offer.

What are the VA loan minimum property requirements?

VA loans come with Minimum Property Requirements (MPRs), which ensure that the home you are purchasing is safe, sound, and secure. These requirements include basic conditions, adequate roofing, reliable heating, safe access to the property, and a functioning water supply. The goal of MPRs is to protect veterans from buying homes that require significant repairs or are unsafe to live in.

If the property does not meet these standards during the VA appraisal, the appraiser may require certain repairs to be made before the loan can be approved. Common issues might include inadequate heating, electrical problems, or structural damage. Ensuring that the property meets these requirements before the appraisal can help avoid delays in the home buying process.

How long does it take to close on a VA loan?

Closing on a VA loan takes between 40 to 50 days, which is comparable to the timeline for conventional mortgages. It is possible to close in as little as 30 days under ideal circumstances, when working with an experienced VA lender and having all necessary documentation ready in advance. The timeline can be influenced several factors, including the speed of the appraisal process, the presence of any required repairs, and the efficiency of the underwriting process.

To expedite the closing process, it is crucial to get pre-approved early, respond promptly to lender requests for additional information, and ensure that the home meets all VA Minimum Property Requirements (MPRs) before the appraisal. Working with a VA loan specialist can also help streamline the process, potentially leading to a quicker closing

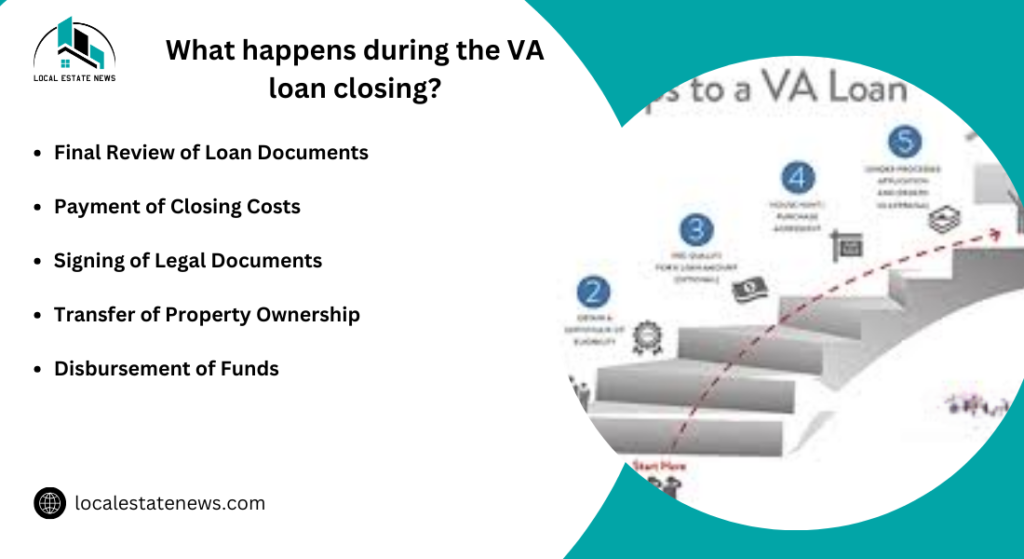

What happens during the VA loan closing?

The VA loan closing is the final step in the home buying process, where all the necessary paperwork is signed, and the property officially changes hands. During the closing, you will review and sign several documents, including the final loan agreement, the Closing Disclosure, and the deed of trust. You will also need to provide a cashier’s check or arrange for a wire transfer to cover any closing costs that are not rolled into your loan.

The closing process can take about an hour, and once completed, the lender will release the funds, and you will receive the keys to your new home. It is a moment of celebration after a process that may have involved numerous steps and requirements, but it marks the official beginning of your homeownership journey.

How long does it take to close on a VA loan?

The time it takes to close on a VA loan ranges from 40 to 50 days, which is similar to the average time frame for conventional loans. Under ideal circumstances working with a knowledgeable VA lender and ensuring that all necessary documents are submitted promptly it is possible to close in as little as 30 days. Factors that influence the closing timeline include the speed of the appraisal process, the time needed to complete any required repairs, and the efficiency of the underwriting process. Being proactive and maintaining clear communication with your lender can help expedite the closing process.

What are the VA loan minimum property requirements?

VA loans require that the property meets specific Minimum Property Requirements (MPRs) to ensure the home is safe, sanitary, and structurally sound. These requirements include criteria for the roof, foundation, heating and cooling systems, and access to safe water and adequate sewage disposal. The property must also be free from health hazards, Lead-based paint or pest infestations. If the VA appraisal identifies any issues that fail to meet these standards, the necessary repairs must be completed before the loan can proceed to closing. These requirements are in place to protect veterans and ensure they are purchasing homes that meet basic safety standards.

What happens during the VA loan closing?

The VA loan closing is the final step in the home buying process, where all the necessary documents are signed, and ownership of the property is officially transferred. During the closing, you will review and sign several key documents, including the loan agreement, the Closing Disclosure, and the deed of trust. You’ll also need to provide a cashiers check or arrange for a wire transfer to cover any closing costs not included in the loan. The documents are signed and the lender has released the funds, you will receive the keys to your new home, marking the completion of your home buying journey. What is FHA Loan, detailed

Conclusion: What should you take away from the VA loan process?

The VA loan process, while involving several steps and specific requirements, is designed to offer veterans and service members a favorable path to homeownership. The timeline for closing, the Minimum Property Requirements (MPRs), and the steps involved in the closing process can help you navigate this journey smoothly. By being proactive, all necessary documentation is prepared, and working closely with a VA-approved lender, you can successfully secure a VA loan and enjoy the benefits of homeownership. The VA loan program’s unique advantages, no down payment and no private mortgage insurance, make it an invaluable resource for those who have served our country.