The pre-approval process is a crucial step for

clear picture of how much financing they can qualify for. This process not only helps you, your budget but also gives you an edge in a competitive real estate market by signaling to sellers that you are a serious and qualified buyer. Unlike pre-qualification, which offers an estimate based on self-reported information, pre-approval involves a more thorough evaluation of your financial history, credit score, and other critical factors. This article delves into the intricacies of the pre-approval process, offering insights and tips to help you navigate it with confidence.

- Mortgage pre-approval

- Home loan pre-approval

- Loan application process

- Credit score impact on pre-approval

- Mortgage lender requirements

- Pre-approval checklist

- Financial documents for pre-approval

- Mortgage eligibility criteria

How Does the Pre-Approval Process Differ from Pre-Qualification?

The pre-approval process and pre-qualification are often used interchangeably, but they serve different purposes in the mortgage application process. Pre-qualification is a preliminary step where lenders make an initial assessment of your financial situation based on self-reported information. It is a quick and informal process that gives you a ballpark figure of how much you might be able to borrow, but it doesn’t carry much weight because the information isn’t verified.

pre-approval is a more thorough and formal process. It involves the lender verifying your financial documents, such as pay stubs, tax returns, and credit reports. As a result, pre-approval provides a more accurate and reliable estimate of how much you can borrow, having a pre-approval letter in hand signals to sellers that you are a serious buyer, making your offer more attractive compared to someone who is only pre-qualified.

What Are the Steps, the Pre-Approval Process?

The pre-approval process involves several key steps:

- Financial Documentation: You will need to provide comprehensive financial documents, including recent pay stubs, W-2 forms, tax returns, and bank statements. These documents allow the lender to verify your income, assets, and overall financial stability.

- Credit Check: The lender will perform a hard credit inquiry to assess your creditworthiness. This step may temporarily affect your credit score but is necessary to evaluate your debt-to-income ratio and credit history.

- Pre-Approval Letter: If the lender is satisfied with your financial documentation and credit score, they will issue a pre-approval letter. This letter states the loan amount you are approved for and can be presented to sellers when making an offer on a home. It demonstrates your financial capability and increases your chances of having your offer accepted.

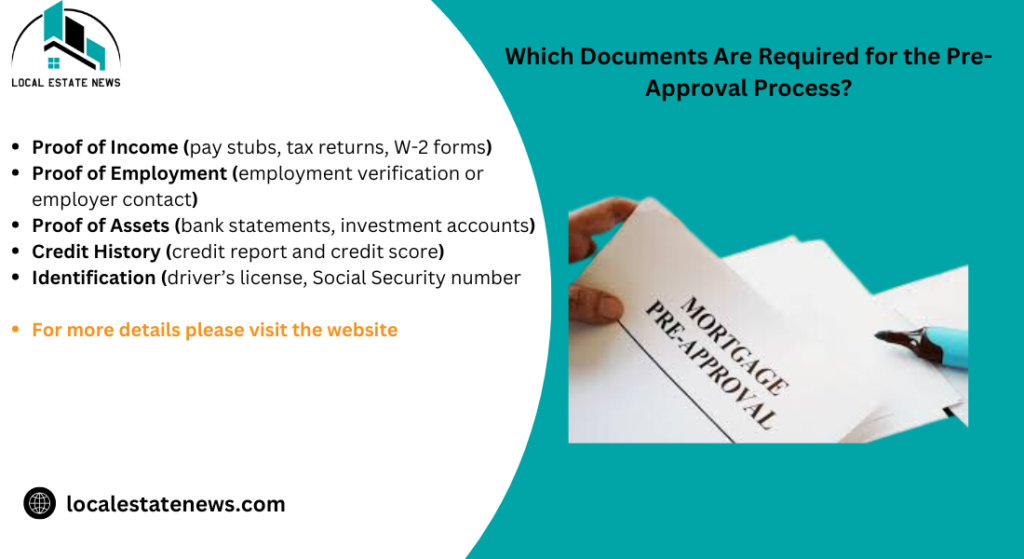

Which Documents Are Required for the Pre-Approval Process?

To get pre-approved for a mortgage, you will need to gather several important documents:

- Income Verification: This includes your most recent pay stubs, W-2 forms, and possibly your tax returns if you’re self-employed. These documents help the lender confirm your income and ensure that it is stable and sufficient to cover your future mortgage payments.

- Asset Statements: You will need to provide statements for your bank accounts, retirement accounts, and any other investments. Lenders use this information to verify that you have enough funds for a down payment and closing costs.

- Credit Information: The lender will access your credit report to review your credit history, score, and existing debts. You’ll also need to provide personal identification, such as your drivers license or passport.

What Factors Do Lenders Consider During the Pre-Approval Process?

When going through the pre-approval process, lenders evaluate several critical factors to determine your eligibility for a mortgage. These factors help lenders assess your ability to repay the loan and gauge the level of risk involved in lending to you.

- Credit Score: Your credit score is a primary factor that lenders consider. It reflects your credit history and payment behavior. A higher credit score indicates lower risk to the lender, which could result in better loan terms and interest rates. Most conventional loans require a minimum credit score of 620, but for government-backed loans like FHA, the requirement may be lower. Scores above 740 generally qualify you for the best rates.

- Debt-to-Income Ratio (DTI): The DTI ratio is the percentage of your gross monthly income that goes towards paying your debts. Lenders prefer a DTI ratio of 43% or lower, although some programs may allow higher ratios for applicants with strong credit. This ratio helps determine how much of your income is already committed to debt repayment and how much can be allocated to a mortgage payment.

- Employment and Income Verification: Lenders will verify your employment status and income through pay stubs, W-2 forms, and tax returns. They may also contact your employer directly. Consistent and stable income is crucial for securing pre-approval, as it demonstrates your ability to make regular mortgage payments.

These factors are integral to the pre-approval process, helping lenders decide not only whether to approve your loan but also under what terms.

How Long Does the Pre-Approval Process Take?

The duration of the pre-approval process can vary depending on several factors, but typically, you can expect it to take anywhere from a few days to a couple of weeks. Here’s what influences the timeline:

- Document Submission: The speed at which you can gather and submit the required financial documents plays a significant role. If you have all your documents ready, pay stubs, tax returns, and bank statements, the process can move more quickly.

- Lenders Processing Time: Different lenders have different processing times. Some may provide a pre-approval decision within a few hours if you apply online, while others might take several days as they manually review your documents and run a thorough credit check.

- Complexity of Your Financial Situation: If you have a straightforward financial situation with steady income and good credit, the process will likely be faster, if your financial situation is more complex, being self-employed or having multiple sources of income, it may take longer for the lender to verify all the details.

While the pre-approval process generally doesn’t take very long, it is advisable to start early to avoid any delays that could affect your ability to make an offer on a home.

What Are the Common Challenges in the Pre-Approval Process and How to Overcome Them?

The pre-approval process can sometimes present challenges, but understanding these potential hurdles can help you navigate them more effectively:

- Credit Score Issues: One common challenge is discovering that your credit score is lower than expected, which can limit your mortgage options or result in higher interest rates. To overcome this, review your credit report before applying for pre-approval and take steps to improve your score, paying down debts and disputing any errors on your report.

- High Debt-to-Income Ratio: A high DTI ratio can also be a stumbling block, as lenders might see you as over-leveraged. Reducing your DTI ratio can be achieved by paying off existing debts or increasing your income. Sometimes, lowering your target loan amount can also help you stay within acceptable DTI limits.

- Insufficient Documentation: Failing to provide all the necessary documentation promptly can delay the pre-approval process. To avoid this, prepare in advance by gathering all required documents such as tax returns, pay stubs, bank statements, and any other relevant financial records.

How to Choose the Right Lender for the Pre-Approval Process

Selecting the right lender for your mortgage pre-approval is a critical step that can significantly impact your home-buying experience. Here are some key considerations to help you make an informed choice:

- Interest Rates and Fees: One of the most important factors to consider when choosing a lender is the cost of borrowing. This includes not just the interest rate, but also other associated fees origination fees, application fees, and closing costs. Some lenders might offer lower interest rates but compensate by charging higher fees. It is essential to get a detailed breakdown of all potential costs to understand the true cost of the loan.

- Customer Service: The quality of customer service can make a big difference in your pre-approval process. You want a lender who is responsive, communicates clearly, and is willing to guide you through each step of the process. Reading online reviews and getting recommendations from friends, family, or your real estate agent can help you gauge the lender’s reliability and customer service standards.

- Loan Products and Specialization: Different lenders offer various types of mortgage products. Whether you need a conventional loan, an FHA loan, a VA loan, or a jumbo loan, it is important to choose a lender that specializes in the type of mortgage that best suits your needs. Additionally, some lenders may offer specific programs that could benefit you, first-time homebuyer assistance or down payment assistance.

What Are the Benefits of Getting Pre-Approved Before House Hunting?

Getting pre-approved before you start house hunting offers several significant advantages:

- Clear Budget Understanding: A pre-approval gives you a clear understanding of how much you can afford to spend on a home. This helps you narrow down your search to properties within your budget, saving you time and avoiding the disappointment of falling in love with a house that’s out of your financial reach.

- Stronger Negotiation Position: A pre-approval letter demonstrates to sellers that you are a serious buyer with the financial backing to complete the purchase. This can give you an edge in competitive markets, as sellers are more likely to favor offers from pre-approved buyers over those who are not yet pre-approved.

- Faster Closing Process: Since much of the financial vetting has already been done during the pre-approval process, the final approval and closing stages can move more quickly. This can be particularly advantageous if you need to close on a property within a tight timeframe.

Can the Pre-Approval Process Affect Your Credit Score?

Yes, the pre-approval process can affect your credit score, but in a minor way:

- Hard Credit Inquiry: When you apply for pre-approval, the lender will perform a hard inquiry on your credit report. This type of inquiry can temporarily lower your credit score by a few points, the impact is usually minimal and short-lived.

- Multiple Inquiries: If you apply for pre-approval with multiple lenders within a short period (14-45 days), credit scoring models often treat these inquiries as a single event. This minimizes the overall impact on your credit score, allowing you to shop around for the best mortgage terms without significantly hurting your credit.

- Long-Term Impact: While the initial drop in your credit score may seem concerning, it is important to remember that the impact of hard inquiries diminishes over time. By maintaining good credit habits, such as paying bills on time and reducing debt, you can quickly recover any points lost during the pre-approval process

How to Improve Your Chances of Getting Pre-Approved

Improving your chances of getting pre-approved for a mortgage involves focusing on several key financial areas:

- Enhance Your Credit Score: Your credit score is one of the most critical factors in the pre-approval process. Start by checking your credit report for any errors and disputing inaccuracies. Pay your bills on time, reduce outstanding debt, and aim to keep your credit utilization ratio below 30%. The higher your credit score, the better your chances of approval and securing favorable interest rates.

- Reduce Your Debt-to-Income Ratio (DTI): Lenders prefer a DTI ratio of 43% or lower. To improve your DTI ratio, focus on paying down existing debts and avoid taking on new debt. Increasing your income through additional employment or side gigs can also help improve this ratio, making you a more attractive borrower.

- Save for a Larger Down Payment: A substantial down payment, ideally 20% or more, not only increases your chances of pre-approval but also helps you avoid paying private mortgage insurance (PMI). Larger down payments reduce your loan-to-value (LTV) ratio, which lenders view favorably as it indicates lower risk.

What Happens After the Pre-Approval Process is Completed?

After you receive your pre-approval, the next steps involve focusing on finding the right property within your budget and completing the mortgage application process:

- House Hunting: With a pre-approval letter in hand, you can now search for homes within the pre-approved price range. This letter also makes your offers more competitive, as sellers will view you as a serious buyer with the financial backing to close the deal.

- Final Loan Approval: You have found a home and your offer is accepted, your lender will initiate the underwriting process. During this stage, the lender will thoroughly review your financial situation to ensure nothing has changed since your pre-approval. The property will also need to be appraised to confirm its value matches the loan amount.

- Closing: If everything checks out during underwriting, you will proceed to closing. At this point, all final documents are signed, and the mortgage is finalized. You will pay closing costs, which may include fees for the loan application, appraisal, and more, and then you will officially own your new home.

Can You Get Pre-Approved for a Mortgage with Bad Credit?

Yes, it is possible to get pre-approved for a mortgage with bad credit, though it may be more challenging and come with less favorable terms:

- FHA and VA Loans: Government-backed loans, FHA and VA loans, are more lenient with credit score requirements. For example, FHA loans may approve borrowers with scores as low as 580 with a 3.5% down payment. VA loans, available to veterans and active-duty service members, also offer flexible credit requirements.

- Higher Down Payments: If you have a low credit score, making a larger down payment can improve your chances of pre-approval. This shows the lender that you have significant financial skin in the game and are less of a risk.

- Improving Financial Standing: Even if you have bad credit, working to improve your overall financial situation, reducing your DTI and building up savings, can enhance your pre-approval prospects. Some lenders may offer conditional pre-approvals, where you need to meet specific requirements before final approval

What Are the Differences Between Online and In-Person Pre-Approval Processes?

The online pre-approval process offers convenience and speed, making it an increasingly popular choice among homebuyers. Online platforms allow you to complete the entire process from the comfort of your home, often providing decisions within minutes or hours. This method also makes it easy to compare multiple lenders, as many platforms allow you to view different rates and terms side by side, online pre-approvals involve soft credit checks, which have a minimal impact on your credit score.

In contrast, the in-person pre-approval process provides a more personalized experience. Meeting with a loan officer face-to-face allows for immediate, direct communication, where you can ask questions and get detailed explanations. This method might involve more paperwork and time, as it often requires physical copies of your documents and a hard credit check, which could temporarily lower your credit score, the in-person approach is beneficial for those who prefer a more hands-on, guided experience and want to discuss tailored options with a knowledgeable professional.

How Long is a Mortgage Pre-Approval Valid?

The validity of a mortgage pre-approval ranges from 60 to 90 days, depending on the lender. During this period, your financial situation is expected to remain stable, meaning no significant changes in your income, debt levels, or credit score. If you don’t find a home within the pre-approval period, you may need to update your documentation and go through the process again to ensure that your financials still qualify you for the loan amount,

It is important to remember that while the pre-approval letter provides an estimate of how much you can borrow, it doesn’t guarantee final approval. The final approval will depend on the property appraisal, a title search, and an underwriters review of your financial situation just before closing.

What Should You Do If Your Pre-Approval Application is Denied?

If your pre-approval application is denied, it is crucial to understand the reasons behind the decision and take steps to address them. Common reasons for denial include a low credit score, a high debt-to-income (DTI) ratio, or insufficient income.

To improve your chances of approval in the future, start by reviewing your credit report for any errors and take steps to improve your credit score, paying down debt and avoiding new credit inquiries. If your DTI ratio is too high, work on reducing your existing debt or increasing your income. In some cases, making a larger down payment can also help secure approval by lowering your loan-to-value ratio.FHA Loans Guide: Requirements, Rates, limits and Benefits

Consider speaking with your lender to discuss alternative options or to get advice on what specific actions you can take to improve your financial situation. Sometimes, small changes or a different loan product might make all the difference in securing pre-approval.

What Are the Costs Associated with the Pre-Approval Process?

The pre-approval process for a mortgage is free with most lenders. Many lenders do not charge for pre-approval as it is in their best interest to attract potential clients, it is important to note that while the pre-approval itself might be free, moving forward with the full mortgage application could involve certain costs. Some lenders may charge an application fee once you decide to proceed with them, which is why it is essential to inquire about any potential fees upfront during the pre-approval stage.

What Are the Different Costs Associated with Taking Out a Mortgage?

When you secure a mortgage, several types of costs can arise, which can be broadly categorized into upfront costs and ongoing monthly costs:

- Upfront Costs:

- Origination Fees: These are fees charged by the lender for processing the loan. They may include application fees, underwriting fees, and other administrative charges.

- Points: These are optional fees you can pay to lower your interest rate. One point costs 1% of the loan amount.

- Third-Party Fees: These include costs for services like appraisals, title insurance, and credit reports, which are required during the mortgage process.

- Taxes and Government Fees: Depending on your location, there may be taxes or recording fees associated with your mortgage and home purchase.

- Ongoing Monthly Costs:

- Principal and Interest: These are the basic components of your monthly mortgage payment. The principal is the amount borrowed, and the interest is the cost of borrowing that money.

- Mortgage Insurance: If your down payment is less than 20%, you might be required to pay for private mortgage insurance (PMI), which protects the lender in case of default.

- Escrow Payments: These cover property taxes and homeowners’ insurance, which the lender manages on your behalf. Different Costs Associated with a Mortgage.

Is the Pre-Approval Process Different for First-Time Homebuyers?

For first-time homebuyers, the pre-approval process generally follows the same steps as for other buyers, but there are some nuances and additional considerations:

- Special Programs: First-time homebuyers may be eligible for special loan programs that offer lower down payments, reduced interest rates, or assistance with closing costs. Examples include FHA loans, VA loans, and USDA loans, which often have more flexible requirements regarding credit scores and down payments.

- Education and Counseling: Some lenders and government programs offer educational resources or require homebuyer education courses as part of the pre-approval process. These resources can help first-time buyers better understand the mortgage process and prepare for homeownership.

- Down Payment Assistance: First-time buyers may also have access to down payment assistance programs, which can provide grants or low-interest loans to help cover the initial costs of purchasing a home.

These costs and the special considerations for first-time homebuyers, you can navigate the pre-approval process more effectively and avoid surprises as you move forward with your home purchase.

How does the pre-approval process work for different types of loans?

The pre-approval process for different types of loans FHA, VA, and conventional varies slightly in terms of eligibility requirements, documentation, and the overall process. Here’s how the process works for each:

FHA Loans

Federal Housing Administration (FHA) loans are popular among first-time homebuyers and those with lower credit scores. Here’s how the pre-approval process works for FHA loans:

- Credit Score and Down Payment: FHA loans require a minimum credit score of 580 for a 3.5% down payment, though some lenders may approve applicants with scores as low as 500 if they can make a 10% down payment.

- Documentation: You will need to provide the usual financial documentation, including recent pay stubs, tax returns, and bank statements. Lenders will also verify your employment status.

- Debt-to-Income Ratio (DTI): The FHA allows a higher DTI ratio compared to conventional loans, with the maximum DTI ratio often around 43% to 50%.

- Mortgage Insurance: FHA loans require both an upfront mortgage insurance premium (MIP) and monthly MIP payments, regardless of your down payment size.

VA Loans

Veterans Affairs (VA) loans are available to eligible veterans, active-duty service members, and certain members of the National Guard and Reserves. The pre-approval process includes:

- Certificate of Eligibility (COE): Before you can get pre-approved, you need to obtain a COE from the VA. This document proves your eligibility for a VA loan.

- No Down Payment Required: VA loans don’t require a down payment, making them highly attractive to qualified borrowers.

- Credit Score and DTI: While the VA doesn’t set a minimum credit score, most lenders prefer a score of at least 620. The DTI ratio should generally not exceed 41%, but exceptions can be made.

- No Mortgage Insurance: Unlike FHA and conventional loans, VA loans do not require private mortgage insurance (PMI), there is a one-time VA funding fee, which can be rolled into the loan amount.

Conventional Loans

Conventional loans are not backed by a government agency, which means they have stricter requirements:

- Credit Score: Conventional loans generally require a higher credit score, with most lenders looking for a minimum of 620. Higher scores can help secure better interest rates.

- Down Payment: The typical minimum down payment is 5%, though putting down 20% or more can help you avoid PMI.

- Documentation and DTI: You’ll need to provide thorough documentation of your financial situation, including income, assets, and debts. Lenders prefer a DTI ratio below 43%, though this can vary.

- Mortgage Insurance: If your down payment is less than 20%, you will need to pay PMI until your loan-to-value ratio drops below 80%.

Each loan type has specific advantages depending on your financial situation and eligibility, so understanding the nuances of the pre-approval process for each can help you choose the best mortgage option.

What is the Final Takeaway from the Pre-Approval Process?

The pre-approval process is an essential first step in the home-buying journey, offering significant advantages regardless of the type of loan you choose. It gives you a clear understanding of your financial standing and strengthens your position as a serious buyer. Whether you opt for an FHA, VA, or conventional loan, understanding the specific requirements and steps involved in the pre-approval process can help you navigate the complexities of securing a mortgage more effectively.

By obtaining a pre-approval, you not only clarify your budget but also improve your chances of having your offer accepted in a competitive market. The process varies slightly depending on the loan type, but the core benefits, better preparation, increased negotiating power, and a smoother home-buying experience remain the same across the board. Home affordability

Being well-prepared and informed about the pre-approval process puts you in the best possible position to purchase your desired home. It is a strategic move that can make a significant difference in both the short and long term, ensuring that your home-buying experience is as seamless and successful as possible.