Deciding between Buying vs renting a home is one of the most significant financial decisions you will make in your lifetime. This choice involves weighing various factors, including financial stability, long-term goals, lifestyle preferences, and the current real estate market. Both Buying vs renting come with their own set of advantages and challenges, and what might be a perfect solution for one person could be entirely different for another. This article will explore the critical aspects of Buying vs renting, helping you make an informed decision that aligns with your financial situation and lifestyle.

- Homeownership

- Rental property

- Mortgage

- Real estate market

- Lease agreement

- Equity

- Housing market trends

- Long-term investment

- Financial planning

- Monthly rent payments

When is it More Beneficial to Buy a Home Instead of Renting?

Deciding when it is more beneficial to buy a home rather than rent depends heavily on individual financial situations, long-term goals, and lifestyle preferences. Here are key factors to consider:

1. Financial Readiness and Long-Term Investment: Buying vs renting a home is more advantageous when you have the financial stability to afford the costs associated with homeownership. This includes having a secure income, a good credit score, and the ability to make a substantial down payment. When you buy a home, you are investing in an asset that has the potential to appreciate over time, allowing you to build equity. This equity can serve as a significant financial resource in the future, whether through refinancing, selling, or borrowing against your home, renting does not contribute to your net worth, as monthly rent payments do not build equity.

2. Stability and Long-Term Residency: If you plan to stay in one location for a significant period, Buying vs renting a home might be more beneficial. Homeownership provides stability, especially if you have a fixed-rate mortgage, as it protects you from rising rents, owning a home offers a sense of permanence, making it ideal for those looking to settle down, raise a family, or stay within a particular school district. Renting is more suitable for those who value flexibility and might need to relocate for work or personal reasons.

3. Tax Benefits and Cost Control: Homeownership can also be more beneficial due to the tax advantages it offers. Homeowners can deduct mortgage interest and property taxes on their federal income tax returns, which can lead to significant savings. Owning a home allows for more control over housing costs in the long term, as mortgage payments are generally predictable, unlike rent, which can increase annually at the landlords discretion. It is important to consider that homeownership comes with additional costs, maintenance, repairs, and homeowners insurance, which should be factored into the decision-making process

What Are the Financial Advantages of Renting Over Buying?

Renting a home can offer several financial advantages over Buying vs renting, making it a more viable option for many individuals, particularly those who value flexibility and lower upfront costs.

1. Lower Upfront Costs and No Maintenance Expenses: One of the most significant financial advantages of renting is the lower initial cost. Renters only need to pay a security deposit and the first months rent, which is often far less than the substantial down payment required to purchase a home, renters are not responsible for maintenance costs or repairs. If something breaks or needs fixing, it is the landlords responsibility to cover these expenses. This can lead to substantial savings, especially in older properties where maintenance costs can be unpredictable and high.

2. Predictable Monthly Expenses and Flexibility: Renting also offers more predictable monthly expenses compared to homeownership. Renters generally have a set monthly rent, which can include utilities and other fees, making it easier to budget. In contrast, homeowners may face variable costs like property taxes, insurance, and maintenance, which can fluctuate and sometimes increase unexpectedly. Renting also provides greater flexibility, as tenants can move more easily when their lease ends, without the need to sell a property or deal with the complexities of the real estate market.

3. Avoidance of Depreciation and Market Risks: Homeownership involves the risk of property depreciation and fluctuating market values, which can negatively impact the return on investment. Renters, are not affected by these market dynamics. They can avoid the financial risks associated with a declining real estate market, where property values might drop below the purchase price, leading to potential financial losses. This stability makes renting a more secure financial option for those wary of market volatility.

These financial benefits highlight why renting can be a smarter financial choice, particularly for those who prefer flexibility, lower upfront costs, and predictable monthly expenses without the long-term risks associated with homeownership.

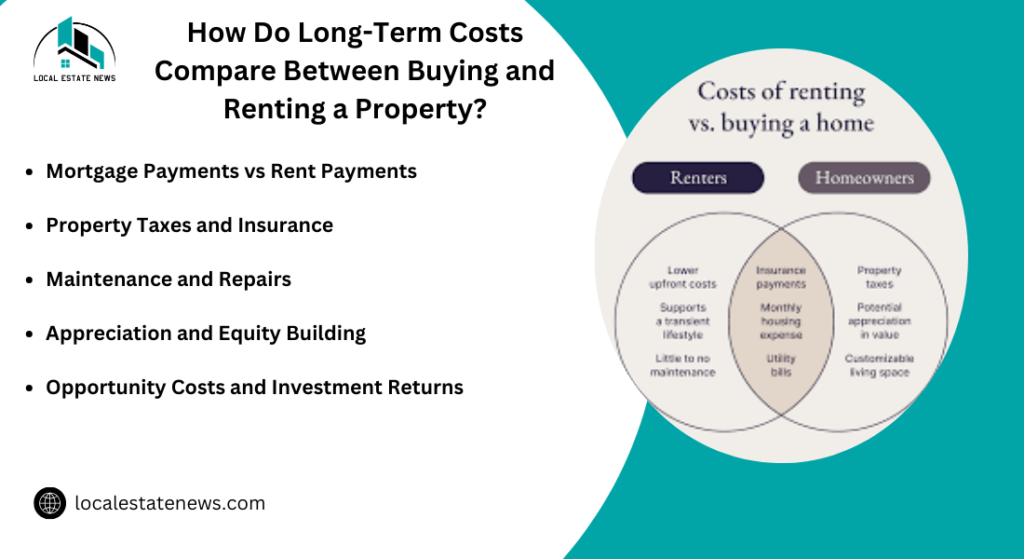

How Do Long-Term Costs Compare Between Buying and Renting a Property?

When comparing the long-term costs of Buying vs renting a property, several factors must be considered, including the total expenditure over time, potential for equity accumulation, and the varying expenses associated with homeownership.

1. Long-Term Financial Commitment: Buying a home involves a significant long-term financial commitment. Homeowners must cover the mortgage, property taxes, homeowners insurance, and maintenance costs, which can add up substantially over the years. In contrast, renters avoid many of these additional expenses and only need to worry about their monthly rent and utilities, while renters have fewer ongoing costs, they also miss out on the opportunity to build equity, which can be a major financial asset over time.

2. Accumulating Equity vs. Rental Savings: One of the primary advantages of homeownership is the potential to accumulate equity as the mortgage is paid down and the property appreciates in value. This equity can eventually become a significant portion of one net worth. On the other hand, renters do not build equity but may have the opportunity to save or invest the money that would otherwise go toward a mortgage, property taxes, and home maintenance. In some cases, these investments might outperform the appreciation of a home, depending on market conditions.

3. Regional Variations in Cost-Effectiveness: The cost-effectiveness of Buying vs renting can also vary significantly based on location. In some high-cost areas, certain cities in California, long-term renting can be significantly cheaper than buying. Studies have shown that in specific markets, renters can save hundreds of thousands of dollars over 30 years compared to homeowners. This disparity is often due to high home prices, expensive down payments, and rising mortgage rates, which make renting a more financially sound option in these regions.

The comparison of long-term costs between Buying vs renting depends on individual circumstances, including financial goals, local market conditions, and the potential for equity growth. For some, the stability and equity that come with homeownership are worth the higher costs, while for others, the flexibility and lower financial burden of renting are more appealing.

What Lifestyle Factors Should Influence the Decision to Buy or Rent?

Beyond financial considerations, lifestyle factors play a critical role in deciding whether to buy or rent a home. These factors include personal goals, career stability, and the need for flexibility.

1. Stability vs. Flexibility: If you value stability and plan to stay in one location for an extended period, buying a home might be the better choice. Homeownership offers a sense of permanence and the ability to customize your living space to suit your preferences. If you prioritize flexibility due to frequent relocations or uncertain career paths, renting offers the freedom to move with fewer complications. This flexibility is particularly important for those who might need to relocate for work or prefer the ability to change living environments without the commitment of selling a home.

2. Long-Term Family Planning: For those planning to start or expand a family, buying a home can provide the stability needed to establish roots and ensure consistency in areas like school districts and community involvement. Homeownership allows for long-term planning in a stable environment, which can be beneficial for raising children. In contrast, renting might be more suitable for individuals or couples without immediate plans for a family, as it allows for greater adaptability in response to changing life circumstances.

3. Personal Preferences and Lifestyle: Your personal preferences and lifestyle should also guide your decision. If you enjoy gardening, home improvements, or the freedom to renovate, buying a home offers the opportunity to personalize your space, if you prefer a low-maintenance lifestyle with minimal responsibilities for repairs and upkeep, renting might be more aligned with your needs. Renters often have access to amenities, pools, gyms, and community spaces without the burden of maintenance, making it an attractive option for those who prefer convenience.

In summary, lifestyle factors, the need for stability, family planning, and personal preferences for maintenance and flexibility are crucial in deciding whether to buy or rent. Weighing these factors against your financial situation will help you make a choice that best fits your current and future needs.

How Does the Local Real Estate Market Affect the Decision to Buy or Rent?

The local real estate market plays a critical role in determining whether it is better to buy or rent a property. Several factors within the market can significantly influence this decision, including housing supply and demand, interest rates, and economic conditions.

1. Supply and Demand Dynamics: The balance between housing supply and demand is a fundamental factor in the real estate market. In areas where there is a high demand for homes but a limited supply, property prices tend to increase, making buying more expensive. In markets, renting can be more cost-effective as it avoids the high upfront costs and potential financial strain of purchasing a home in a sellers market. Conversely, in areas where there is an oversupply of homes and lower demand, property prices may decrease, making buying a more attractive option for those looking to build equity in a buyers market.

2. Interest Rates and Financing Costs: Interest rates are another crucial element that affects the decision to buy or rent. When interest rates are low, mortgages become more affordable, which can encourage buying as a more financially sound decision, when interest rates rise, the cost of borrowing increases, making mortgage payments higher and possibly making renting a more appealing option in the short term. This fluctuation in financing costs directly impacts the overall affordability of buying a home and can sway the decision based on current economic conditions.

3. Economic Conditions and Market Stability: The broader economic environment also influences the real estate market. In a strong economy with rising incomes and job stability, buying a home might be more feasible and attractive, in a weaker economy, where job security is uncertain and incomes are stagnant, Buying vs renting can provide greater financial flexibility and lower risk. Economic downturns often lead to a more cautious approach, where renting is preferred to avoid the long-term financial commitments associated with homeownership.

These factors highlight how local market conditions and economic trends should be carefully considered when deciding whether to buy or rent, as they directly affect the cost, risk, and potential benefits of each option.

What Are the Tax Implications of Buying Versus Renting?

Tax implications are a significant consideration in the decision to buy or rent, as they can greatly affect the overall cost and financial benefits of each option.

1. Tax Deductions for Homeowners: One of the main tax benefits of homeownership is the ability to deduct mortgage interest and property taxes from taxable income. This can result in substantial savings, particularly in the early years of a mortgage when interest payments are high, homeowners may be eligible for other deductions, those for energy-efficient home improvements or home office expenses if applicable. These tax advantages can make homeownership more financially attractive over time, especially for those in higher tax brackets.

2. Limited Tax Benefits for Renters: Renters, on the other hand, generally do not receive direct tax benefits related to their rental payments. While some states or localities may offer renters’ credits or deductions, these are less significant than the tax benefits available to homeowners. Renters do benefit from the simplicity of not having to manage property-related taxes, which can be a relief in areas with high property tax rates.

3. Capital Gains and Home Sale Exclusions: Another tax advantage for homeowners is the capital gains tax exclusion on the sale of a primary residence. If certain conditions are met, homeowners can exclude up to $250,000 (or $500,000 for married couples) of the gain from the sale of their home from taxable income. This exclusion is a significant financial benefit for those who sell their homes after a period of appreciation. Renters, do not have assets that appreciate in value in the same way and therefore miss out on this potential tax advantage.

These tax implications are crucial when weighing the financial pros and cons of Buying vs renting, as they can significantly impact long-term financial planning and outcomes.

How Does Homeownership Impact Your Credit Score Compared to Renting?

Homeownership and renting each have different impacts on an individuals credit score, which is an essential factor in financial health and future borrowing potential.

1. Positive Impact of Mortgage Payments: For homeowners, consistently making mortgage payments on time can have a positive impact on their credit score. Mortgage payments are reported to credit bureaus, and as long as payments are made promptly, this can contribute to a higher credit score over time. A strong credit score, in turn, can lead to better borrowing terms for future loans or refinancing options. Having a mortgage can add to the diversity of one credit profile, which is beneficial for credit scoring.

2. Renting and Credit Score: Renters, on the other hand, may not see the same direct impact on their credit scores from their monthly payments. Rent payments are not always reported to credit bureaus, although some services now offer to report these payments for a fee. Without this reporting, Buying vs renting may not contribute positively to building credit., renters also avoid the risk of damaging their credit through foreclosure or missed mortgage payments, which can significantly harm a credit score.

3. Risk of Negative Impact: While homeownership offers opportunities to build credit, it also comes with risks. Missed mortgage payments or defaulting on a loan can lead to a significant drop in credit score and long-term financial difficulties. Renting offers more flexibility and less risk in this regard, as renters are not responsible for large debts and their potential impact on credit.

What Are the Hidden Costs of Buying a Home That Renters Avoid?

Buying a home involves several hidden costs that can add up significantly, many of which renters do not need to worry about. Understanding these costs is crucial for potential homeowners to budget accurately and avoid financial surprises.

1. Closing Costs and Fees: The first hidden costs homebuyers encounter is closing costs. These range from 2% to 5% of the homes purchase price and can include loan origination fees, appraisal fees, title insurance, and attorney fees. Unlike renters, who generally only pay an application fee and security deposit, homeowners must be prepared to cover these additional expenses right from the start.

2. Maintenance and Repair Costs: Homeownership also brings ongoing maintenance and repair responsibilities. On average, homeowners should budget around 1% of the homes value annually for upkeep, though this can vary depending on the homes age and condition. This includes routine maintenance like lawn care, as well as unexpected repairs, plumbing issues or roof replacements. Renters, in contrast, do not have to pay for these expenses, as they are the landlords responsibility.

3. Property Taxes and Insurance: Homeowners are responsible for paying property taxes and homeowners insurance, which can be significant, especially in areas with high property values or tax rates. These costs are ongoing and can increase over time, adding to the overall expense of owning a home. Renters, on the other hand, are generally only responsible for renters insurance, which is much less expensive and often optional.

How Does Renting Provide Flexibility That Homeownership Does Not?

Renting offers a level of flexibility that homeownership cannot match, making it a more attractive option for individuals who prioritize mobility and adaptability in their living situations.

1. Ease of Relocation: Renters can move with relative ease at the end of their lease, whether for a new job, change in lifestyle, or simply a desire to explore a different neighborhood or city. This flexibility is especially beneficial for those whose careers require frequent relocations or for those who prefer not to be tied down to a single location. Homeowners, in contrast, face the complexities of selling their property, which can be time-consuming and expensive, particularly in a sluggish real estate market.

2. Lower Financial Risk: Renters are not exposed to the financial risks associated with homeownership, declining property values or unexpected maintenance costs. If the local real estate market takes a downturn, renters can choose to relocate without worrying about selling a depreciating asset. Homeowners, must contend with the markets ups and downs and the potential financial losses that can come with it.

3. No Long-Term Commitment: Leasing a property involves a short-term commitment, usually ranging from one to two years. This makes it easier for renters to adjust their housing situation based on changes in their personal or financial circumstances. Homeownership, involves a long-term commitment, both financially and in terms of lifestyle, as selling a home and moving is a more involved process.

What Are the Long-Term Financial Impacts of Home Equity Compared to Rental Savings?

The financial implications of building home equity versus accumulating rental savings are substantial and vary depending on individual circumstances and market conditions.

1. Building Home Equity: Main financial benefits of homeownership is the ability to build equity over time. As homeowners pay down their mortgage, they increase their ownership stake in the property, which can grow in value as the real estate market appreciates. This equity can be a valuable financial asset, serving as collateral for loans or a source of funds through a home equity line of credit (HELOC) or by selling the home. Over the long term, home equity can significantly contribute to personal wealth.

2. Rental Savings and Investment: Renters do not build equity but can potentially save the money that would otherwise go toward a mortgage, property taxes, and maintenance costs. These savings can be invested in other assets, stocks or retirement accounts, which may offer higher returns than real estate, depending on market conditions. For some, particularly in high-cost housing markets, renting and investing the difference may result in greater financial gains over time than homeownership.

3. Risk and Return Considerations: Home equity is not without risk, as property values can fluctuate due to market conditions, and homeowners may face significant losses if they need to sell during a downturn. Rental savings, if invested wisely, can offer a more diversified portfolio with potentially less risk, the decision between building home equity and focusing on rental savings depends on individual financial goals, risk tolerance, and market dynamics

How Does Inflation Influence the Decision Between Buying and Renting?

Inflation has a significant impact on the decision to buy or rent, as it affects both the cost of homeownership and renting in different ways.

1. Rising Costs and Homeownership: During periods of high inflation, the cost of borrowing increases as interest rates rise. This makes mortgages more expensive, which can reduce the Buying vs renting power of potential homeowners. Higher interest rates mean that monthly mortgage payments will be higher, making homeownership less affordable for many, owning a home can act as a hedge against inflation, especially if you have a fixed-rate mortgage. The fixed nature of the mortgage payment means that while other costs rise, your mortgage payment remains stable, effectively decreasing in real terms over time as inflation increases.

2. Impact on Renters: Inflation also drives up rental prices, often at a pace that keeps up with or even exceeds the rate of inflation. As inflation pushes up the cost of living, landlords may raise rents to cover their increasing expenses, property taxes and maintenance costs. This can make Buying vs renting more expensive, particularly in areas where housing supply is tight and demand is high. For some, this might push them to consider buying as a more stable long-term financial decision, despite the higher upfront costs associated with homeownership.

3. Balancing the Decision: The decision between Buying vs renting in an inflationary environment depends largely on individual financial situations. Those who can afford the higher upfront costs and are looking for long-term stability may find Buying vs renting more advantageous, particularly if they secure a low fixed-rate mortgage. Those who prioritize flexibility and lower initial expenses may opt to rent, although they should be prepared for potential rent increases. Down payment option is available for home Buying vs renting

What Are the Risks Associated with Buying a Home Versus Renting?

Buying vs renting a home and renting each come with their own set of risks, which should be carefully considered before making a decision.

1. Financial Risks of Homeownership: Homeownership carries significant financial risks, particularly related to the housing market. A downturn in the market can lead to a decrease in property value, potentially leaving homeowners with negative equity—owing more on their mortgage than the home is worth, homeowners are responsible for all maintenance and repair costs, which can be unpredictable and substantial. If a major system like the HVAC or roof fails, the cost to repair or replace it can be thousands of dollars, which is a risk renters avoid.

2. Flexibility and Mobility Risks: One of the major risks associated with homeownership is the lack of flexibility. Selling a home can be time-consuming and costly, especially in a down market. This lack of mobility can be a significant disadvantage for those whose job or personal circumstances might require them to move frequently. Renters, on the other hand, benefit from the flexibility of short-term leases, making it easier to relocate as needed.

3. Market and Economic Risks for Renters: While renting offers flexibility, it is not without risks. Renters face the uncertainty of rent increases, particularly in inflationary periods or when demand for rental properties is high, renters do not build equity, which can be a disadvantage in the long term if home prices rise significantly, Buying vs renting can be less risky in volatile markets where home prices might fall, avoiding the potential financial loss associated with a declining property value.

How Do Property Maintenance Responsibilities Differ Between Homeowners and Renters?

Maintenance responsibilities differ greatly between homeowners and renters, influencing both the cost and effort required to maintain a living space.

1. Homeowners’ Responsibilities: Homeowners are fully responsible for the upkeep and maintenance of their property. This includes routine tasks like lawn care and gutter cleaning, as well as major repairs like fixing a leaky roof or replacing a broken furnace. These responsibilities can be costly and time-consuming, with annual maintenance costs averaging around 1% of the homes value. Unexpected repairs can further strain a homeowners budget, making maintenance one of the significant ongoing costs of homeownership.

2. Renters’ Responsibilities: Renters generally have far fewer maintenance responsibilities. Landlords are responsible for maintaining the property and making necessary repairs, which can be a significant advantage for renters who do not want the burden of handling these issues. While some leases may require tenants to perform basic tasks changing light bulbs or maintaining a small garden, the landlord is usually responsible for more extensive maintenance, fixing plumbing or electrical issues. This reduces the financial and time burden on renters, making Buying vs renting a more convenient option for those who prefer not to deal with maintenance

How Does Renting Impact Mobility and Career Flexibility?

Renting offers significant advantages for individuals who prioritize mobility and career flexibility. The ability to move easily and without the constraints of property ownership is particularly valuable in today’s fast-paced job market.

1. Ease of Relocation: One of the primary benefits of Buying vs renting are the ease with which tenants can relocate. Renters are bound by short-term leases, often ranging from six months to a year, allowing them to move quickly in response to new job opportunities or changes in personal circumstances. This flexibility is especially beneficial for professionals who may need to relocate for career advancements or those who work in industries where job mobility is common. Homeowners, on the other hand, may face significant delays and costs associated with selling a property before they can move.

2. Lower Financial Commitment: Renting also involves a lower financial commitment compared to Buying vs renting a home. Without the need to secure a mortgage, pay property taxes, or cover maintenance costs, renters can allocate more resources toward career development or relocation expenses. This financial flexibility allows renters to pursue job opportunities in different cities or even countries without the burden of a mortgage or the hassle of selling a property. For those in dynamic industries or early in their careers, Buying vs renting can offer the agility needed to take advantage of new opportunities.

3. Freedom to Explore Different Locations: Renting allows individuals to experience living in different neighborhoods, cities, or even countries without the long-term commitment that comes with Buying vs renting a home. This is particularly advantageous for those who are uncertain about where they want to settle long-term or for professionals whose careers may require them to live in multiple locations over time. The flexibility of Buying vs renting enables them to explore and adapt to different environments, which can be crucial for personal and professional growth.

What Are the Environmental Impacts of Renting Versus Owning a Home?

The environmental impacts of Buying vs renting owning a home can vary significantly depending on factors energy consumption, building materials, and personal habits. Each option has its own set of environmental considerations that should be taken into account.

1. Energy Efficiency and Consumption: Renters often have less control over the energy efficiency of their homes compared to homeowners. Many rental properties, particularly older buildings, may not have the most up-to-date energy-efficient appliances or insulation, leading to higher energy consumption and a larger carbon footprint. In contrast, homeowners have the ability to invest in energy-efficient upgrades, installing solar panels, energy-efficient windows, or smart thermostats, which can reduce their environmental impact over time.

2. Building and Material Choices: Homeowners also have the opportunity to choose environmentally friendly building materials and construction practices when building or renovating a home. This includes options like sustainable wood, recycled materials, and low-VOC paints, all of which can contribute to a lower environmental impact. Renters, on the other hand, have limited influence over the materials used in their living spaces, which are determined by the property owner or developer.

3. Shared Resources in Multi-Unit Buildings: Renting in multi-unit buildings, apartment complexes, can have environmental benefits due to shared resources. These buildings often have shared heating, cooling, and water systems, which can be more efficient than individual systems in single-family homes, multi-unit buildings have smaller living spaces, which require less energy to heat and cool, further reducing the environmental impact, the overall efficiency depends on the buildings design and the management of communal resources.

How Can a Rent-to-Own Option Bridge the Gap Between Renting and Buying?

Rent-to-own agreements offer a unique way for renters to gradually transition into homeownership, providing flexibility and the opportunity to build equity over time.

1. Building Equity While Renting: A rent-to-own agreement allows renters to begin building equity in a property while they are still renting., a portion of the rent paid each month is credited toward the purchase price of the home. This can be especially beneficial for individuals who may not yet have the financial means to make a full down payment but are committed to purchasing a home in the future. Over time, the equity built through rent payments can make homeownership more accessible.

2. Flexibility and Reduced Risk: Rent-to-own agreements provide renters with the flexibility to live in a home and experience the neighborhood before fully committing to purchasing the property. This arrangement reduces the risk of buyers remorse, as renters have the option to back out of the purchase if they decide the home is not right for them, the agreement often locks in the purchase price at the start, protecting the renter from potential market increases during the rental period.

3. Time to Improve Financial Standing: For individuals who need time to improve their credit score or save for a down payment, rent-to-own agreements offer a practical solution. Renters can use the rental period to strengthen their financial standing, they are in a better position to secure a mortgage when the time comes to purchase the home. This gradual approach to homeownership can be particularly advantageous for first-time buyers or those recovering from financial setbacks

What Role Does Mortgage Interest Play in the Decision to Buy or Rent?

Mortgage interest plays a critical role in the decision to buy or rent because it directly impacts the overall cost of homeownership. When mortgage interest rates are low, Buying vs renting a home can be more affordable, with lower monthly payments making it easier to build equity over time, when interest rates are high, the cost of borrowing increases, leading to significantly higher monthly payments, which can make renting a more attractive option in the short term. If you calculate Mortgage to buy a home

1. Impact on Monthly Payments: Mortgage interest rates are a major factor in determining the affordability of homeownership. For example, a small increase in interest rates can result in a substantial rise in monthly payments, which might strain your budget. This is especially significant for those on the edge of affordability. In contrast, renting does not involve interest payments, which can make it a more predictable and manageable option during periods of high interest rates.

2. Long-Term Financial Considerations: Despite the short-term benefits of Buying vs renting a home with a mortgage can be advantageous in the long term, especially if interest rates are locked in at a low rate. Over time, homeowners can benefit from the tax deductions on mortgage interest, which can offset some of the costs, as the loan principal is paid down, the amount going towards interest decreases, and more of each payment contributes to building equity.

3. Influence of Market Conditions: The broader economic conditions also play a role in how mortgage interest impacts the decision to buy or rent. In an inflationary environment, interest rates rise, which can deter potential homebuyers due to higher borrowing costs, Buying vs renting can still be a sound investment if you plan to stay in the home long enough to benefit from property appreciation and equity accumulation, despite the initial high-interest rates.

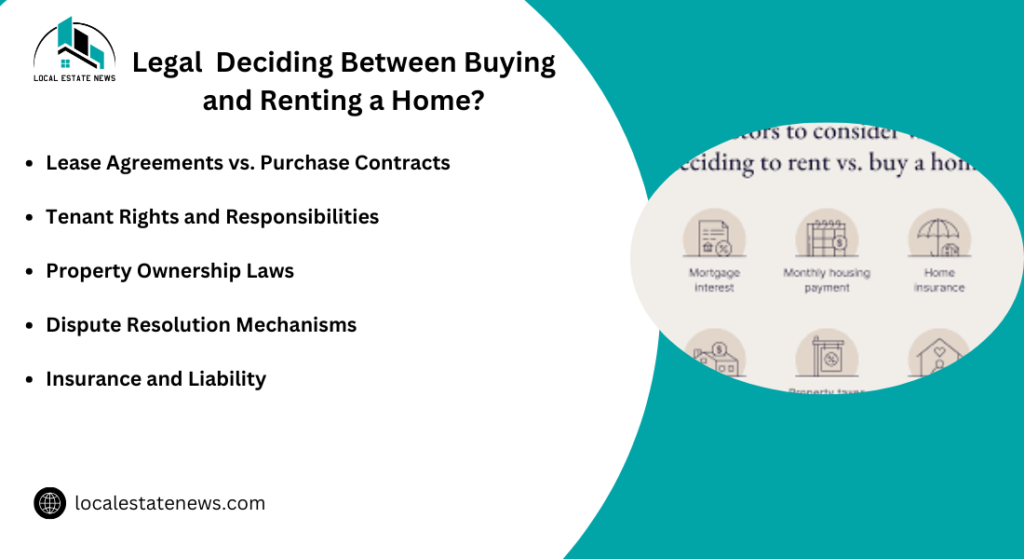

What Are the Legal Considerations When Deciding Between Buying and Renting a Home?

Legal considerations are crucial when deciding between Buying vs renting, as they affect the rights, responsibilities, and long-term commitments associated with each option.

1. Property Ownership and Legal Rights: When you buy a home, you gain legal ownership of the property, which comes with certain rights and responsibilities. Homeowners have the freedom to make modifications, sell the property, or use it as collateral for loans, they are also responsible for legal obligations paying property taxes, adhering to zoning laws, and complying with homeowners’ association (HOA) rules if applicable. These legal responsibilities can be complex and require careful consideration before purchasing a home.

2. Lease Agreements and Renters Rights: Renting, on the other hand, involves a lease agreement that outlines the terms of occupancy, including the duration, rent amount, and maintenance responsibilities. Tenants have certain rights under landlord-tenant laws, protection from unlawful eviction and the right to a habitable living environment. They must also adhere to the lease terms and may face legal action if they breach the contract. Renting generally involves fewer legal complexities compared to Buying vs renting, but it offers less control over the property.

3. Long-Term Commitment and Legal Implications: Buying vs renting a home is a long-term legal commitment, often involving a 15- to 30-year mortgage. This commitment can be difficult to break without significant financial and legal consequences, foreclosure. Renting offers more flexibility, with lease terms ranging from six months to a year, allowing tenants to relocate with fewer legal and financial repercussions. Renters do not build equity or have the same level of investment in the property as homeowners do.

How Does Renting or Buying a Home Affect Your Mobility and Career Flexibility?

Mobility and career flexibility are key factors to consider when deciding whether to rent or buy a home. Renting generally provides more flexibility, which can be crucial for individuals who need to relocate frequently for work or personal reasons.

1. Flexibility in Relocation: Renters benefit from the ability to move with relative ease, as lease agreements last for one year or less. This flexibility is ideal for those who may need to change locations due to job transfers, promotions, or other career opportunities. Renting allows individuals to respond quickly to career changes without the burden of selling a property, which can be time-consuming and financially challenging.

2. Impact on Career Opportunities: The flexibility of renting can also open up more career opportunities, as it allows individuals to explore different cities or regions without the long-term commitment of homeownership. This can be particularly advantageous for professionals in industries where job mobility is common or for those early in their careers who are still exploring their options. On the other hand, homeownership can tie individuals to a specific location, which might limit their ability to pursue career advancements that require relocation.

3. Financial Considerations and Mobility: While renting offers more mobility, it does come with the downside of not building equity, which is a key financial benefit of homeownership, the lower financial commitment and reduced responsibility for property maintenance can make renting a more attractive option for those who prioritize career flexibility over long-term financial investment.

Energy Efficiency and Consumption

Homeowners generally have more control over the energy efficiency of their properties. They can invest in energy-efficient upgrades installing solar panels, upgrading insulation, or using energy-efficient appliances. These improvements can significantly reduce a homes carbon footprint over time. In contrast, renters often have limited control over the energy efficiency of their living spaces. Many rental properties, particularly older buildings, may lack modern energy-saving technologies, leading to higher energy consumption and a larger environmental impact.

Building Materials and Construction

When owning a home, individuals can choose environmentally friendly building materials and practices during construction or renovation, using sustainable wood, recycled materials, or low-VOC paints. Homeowners can also choose to build smaller, more energy-efficient homes that require fewer resources to construct and maintain, renters have little to no influence over the building materials used in their rental properties, which are determined by the property owner or developer.

Shared Resources in Multi-Unit Buildings

Renting in multi-unit buildings, apartment complexes, can have environmental benefits due to the shared resources. These buildings often have centralized heating, cooling, and water systems that serve multiple units, which can be more energy-efficient than individual systems in single-family homes, multi-unit buildings generally have smaller living spaces, which require less energy to heat and cool, further reducing the overall environmental impact, the efficiency of these systems depends on the buildings design and how well the resources are managed.

Maintenance and Waste Generation

Homeowners may generate more waste due to frequent home improvement projects, landscaping, and maintenance activities. These activities often involve the disposal of old materials and the purchase of new products, which can contribute to environmental degradation if not managed sustainably. Renters, on the other hand, have fewer responsibilities for property maintenance and renovations, leading to less waste generation, this also means that they may have less control over how their living space is maintained, potentially leading to inefficient or environmentally harmful practices.

How do building materials and construction practices impact the environment in renting versus owning?

Homeowners can select environmentally friendly building materials when constructing or renovating their homes, sustainable wood, recycled materials, or low-VOC paints. This choice can minimize the environmental impact of their homes. Renters have no control over the construction materials used in their living spaces, as these decisions are made by property owners or developers. This lack of influence means renters are more likely to live in homes that may not prioritize sustainable building practices.

What are the environmental benefits of living in multi-unit rental buildings?

Renting in multi-unit buildings, apartments, can be more environmentally friendly due to shared resources. These buildings often have centralized systems for heating, cooling, and water, which can be more energy-efficient than individual systems found in single-family homes. apartments usually have smaller living spaces that require less energy to maintain, further reducing the environmental impact, the overall efficiency depends on the buildings design and management practices.

Conclusion: Which Option is More Environmentally Friendly?

The environmental impacts of renting versus owning a home vary depending on several factors, including energy efficiency, building materials, and the type of living arrangement. Homeownership provides individuals with the opportunity to implement sustainable practices, using eco-friendly building materials and improving energy efficiency. It also comes with the responsibility of maintaining these practices over time, which can generate waste if not managed properly. Buying vs renting, particularly in multi-unit buildings, can offer environmental benefits through shared resources and smaller living spaces, but it often limits the renters ability to influence energy efficiency and sustainability. your budget for home buying

In conclusion, the choice between Buying vs renting and owning a home should consider environmental impacts alongside personal and financial factors. For those who prioritize sustainability and have the means to invest in energy-efficient upgrades, homeownership can offer significant environmental benefits. renting in well-managed, energy-efficient multi-unit buildings can be a more sustainable option for those who seek flexibility and lower responsibility for maintenance. Ultimately, both Buying vs renting and owning can be environmentally friendly depending on how each option is managed and the choices made by the individuals involved