Navigating the home loan process can be a daunting task, especially for first-time homebuyers. Each step involved can help you make informed decisions and streamline your path to homeownership. The home loan process involves several key stages, including preparing your application, getting pre-approved, finding the right property, and ultimately closing the deal. Each stage requires careful attention to detail to ensure a smooth transaction.

Starting the journey towards securing a Home Loan Process begins with thorough preparation and understanding of what lenders require. This includes gathering necessary documents, your financial situation, and selecting the right type of loan that suits your needs. And equipping yourself with this knowledge, you can confidently navigate the complexities of the home loan process, ensuring you get the best possible deal on your mortgage.

What is the Home Loan Process?

The home loan process involves several steps designed to ensure that both the lender and the borrower are adequately prepared for the financial commitment involved in purchasing a home. Here’s an overview of the key stages in the home loan process:

Step 1: Pre-Approval

Before you start house hunting, it s essential to get pre-approved for a mortgage. This step involves a lender reviewing your financial situation including your credit score, income, and debt-to-income ratio to determine how much they are willing to lend you. Pre-approval not only gives you a clear budget but also makes you a more attractive buyer to sellers.

Step 2: House Hunting and Making an Offer

Once pre-approved, you can start looking for your dream home, and can get home Loan process. Work with a real estate agent to find properties that meet your criteria. When you find a home you love, your agent will help you make an offer. This offer includes the purchase price and any contingencies, home inspections or financing requirements. If the seller accepts your offer, you will move on to securing your mortgage.

Step 3: Applying for a Mortgage

With an accepted offer, you will formally apply for a mortgage. This step involves submitting a complete mortgage application and providing additional documentation, proof of income, tax returns, and details about your assets and debts. Your lender will also conduct a detailed review of your credit history during this stage.

Step 4: Loan Processing and Underwriting

During the loan processing stage, the lender verifies all the information you have provided and orders an appraisal of the property to determine its market value. The underwriter reviews your financial status and the property appraisal to ensure everything meets the lenders criteria. This process may involve requests for additional information or documentation.

Step 5: Closing the Loan

Underwriting process is complete and your loan is approved, you will move to the closing stage. During closing, you will sign all necessary documents, pay any closing costs, and provide your down payment. After everything is finalized, you will receive the keys to your new home and officially become a homeowner.

How to Prepare for a Home Loan Application?

Preparing for a Home Loan Process application is a critical first step in the home-buying process. Here’s how you can effectively prepare:

Assess Your Finances

Before applying for a mortgage, it is essential to evaluate your financial situation. Start by calculating your debt-to-income (DTI) ratio, which helps determine how much you can afford, your DTI should be below 43% to qualify for most loans, review your credit score and take steps to improve it if necessary. A higher credit score can secure better interest rates and terms. Using a home affordability calculator can help you understand home Loan process and what home price is within your reach and align your expectations with your budget.

Gather Necessary Documents

Having all the required documents ready can streamline your mortgage application process. Common documents include:

- Personal identification (Social Security number and ID)

- Income verification (W-2s, pay stubs, or tax returns if self-employed)

- Bank statements

- Proof of other debts and assets

- Employment verification details

special circumstances might require extra documentation, divorce decrees, proof of child support payments, or bankruptcy documentation.

What Documents are Required for a Home Loan?

To apply for a home loan, you will need to provide various documents that verify your financial status and eligibility. Here’s a list of the essential documents:

Personal and Income Documentation

Lenders will require identification and proof of income to ensure you can afford the loan. Gather the following:

- Personal ID: Social Security number and government-issued ID.

- Income Verification: Recent W-2s, pay stubs, and tax returns if you are self-employed. Ensure these documents cover at least the past two years.

- Bank Statements: Recent statements from all accounts, showing sufficient funds for down payment and closing costs.

Credit and Debt Information

Lenders will also need to evaluate your creditworthiness and current debt obligations:

- Credit Report: Lenders will pull your credit report to assess your credit history and score.

- Debt Documentation: List of current debts, including car loans, credit cards, and any other outstanding obligations.

- Additional Documentation: If applicable, provide documents, divorce decrees, child support documentation, or bankruptcy papers.

How to Get Pre-Approved for a Mortgage?

Getting pre-approved for a mortgage is a crucial step that can enhance your home buying process:

Understanding Pre-Approval

Pre-approval involves a thorough examination of your financial background by a lender to determine how much they are willing to lend you. This includes reviewing your credit report, income, assets, and debts. Pre-approval gives you a clearer picture of your budget and makes you more attractive to sellers, as it shows you are a serious and qualified buyer.

Steps to Get Pre-Approved

- Select a Lender: Research and compare different lenders to find the best rates and terms.

- Submit an Application: Provide your chosen lender with the necessary personal and financial information. This usually involves filling out an application form and submitting the required documents.

- Receive Pre-Approval Letter: Once the lender reviews your information, you will receive a pre-approval letter stating the loan amount you qualify for. This letter can be a powerful tool during your home search, giving you a competitive edge when making offers.

How to Find the Right Property for Your Home Loan?

Finding the right property is a crucial step in the home buying process. Here are some strategies to help you identify the perfect home that fits your needs and budget:

Define Your Needs and Budget

Start by outlining your must-haves and nice-to-haves in a home. Consider factors, location, size, number of bedrooms and bathrooms, and proximity to schools or work. Establishing a clear set of criteria will help narrow down your search and make the process more efficient, it is important to stick to a budget that aligns with your financial situation. Getting pre-approved for a mortgage will give you a clear understanding of how much you can afford and prevent you from looking at properties outside your price range.

Work with a Real Estate Agent

A knowledgeable real estate agent can be an invaluable resource in your home search. Agents have access to a wide range of listings, including properties that might not be publicly advertised. They can provide insights into local market trends, help you find properties that meet your criteria, and assist in negotiating the best price, real estate agents can handle the paperwork and guide you through the complex buying process, making your experience smoother and less stressful.

How to Make an Offer on a Property?

Once you have found a home that meets your needs, the next step is to make an offer. Here’s how to proceed:

Research Comparable Sales

Before making an offer, research recent sales of similar homes in the same area to understand the market value. This information will help you make a competitive and reasonable offer. Real estate websites and your agent can provide data on comparable sales, also known as “comps,” to guide your decision.

Write a Strong Offer

Your offer should be compelling to the seller while protecting your interests. It typically includes the proposed purchase price, a timeline for closing, and any contingencies, obtaining financing or a satisfactory home inspection. Including a pre-approval letter from your lender can strengthen your offer by demonstrating that you are a serious and qualified buyer.

What is the Importance of a Home Inspection?

A home inspection is a critical step in the home buying process, providing you with essential information about the condition of the property:

Identify Potential Issues

A thorough home inspection can uncover hidden problems that might not be visible during a casual walk-through. Inspectors check the condition of the roof, foundation, plumbing, electrical systems, and more. Identifying these issues early on can save you from costly repairs in the future and give you leverage to negotiate repairs or a lower purchase price with the seller.

Ensure Safety and Compliance

Home inspections also ensure that the property complies with safety standards and building codes. Inspectors look for hazards mold, faulty wiring, and structural weaknesses. Ensuring the home meets safety regulations protects your investment and your families well-being

How to Choose the Best Mortgage Lender?

Choosing the best mortgage lender involves a complete evaluation of different options to ensure you get the most favorable terms and conditions for your home loan. Here are some essential steps to guide you in selecting the right mortgage lender:

Assess Your Financial Situation

Before you start shopping for lenders, it is crucial to get your finances in order. Check your credit score, as a higher score can qualify you for better interest rates and loan terms. Aim to have a low debt-to-income ratio, as this can also improve your chances of securing a good loan. Ensuring your finances are in shape will make you a more attractive candidate to lenders and can potentially save you thousands of dollars over the life of the loan.

Compare Loan Options and Rates

Different lenders offer various types of loans, conventional, FHA, VA, and USDA loans, each with its own set of requirements and benefits. Research and compare the loan products offered by multiple lenders. Pay attention to the interest rates, loan terms, and any additional fees. It is beneficial to get quotes from at least three to five lenders to ensure you are getting the best deal. Keep in mind that mortgage rates can change daily, so gather your loan estimates on the same day to make accurate comparisons.

Evaluate Lender Reputation and Customer Service

A lenders reputation and the quality of their customer service are critical factors to consider. Look for reviews and ratings from other borrowers to get a sense of their experiences. Good customer service can make the mortgage process smoother and less stressful, especially when dealing with the complexities of a home loan, consider seeking recommendations from friends, family, or your real estate agent. They may have valuable insights or personal experiences with certain lenders.

How to Lock Your Mortgage Rate?

Locking your mortgage rate is a strategic move that can protect you from potential increases in interest rates before your loan closes. Here’s how you can effectively lock your rate:

Understand the Rate Lock Process

A rate lock is an agreement between you and your lender that guarantees a specific interest rate for a set period, 30 to 60 days, though longer periods are available at an additional cost. This lock ensures that even if interest rates rise, you will still receive the locked rate at closing, if rates fall, you will not benefit from the lower rates unless you have a “float down” option.

Determine the Right Time to Lock Your Rate

The best time to lock your rate is after you have a clear understanding of the market trends and are satisfied with the current rate being offered. Consult with your lender or a financial advisor to get insights into potential rate movements. Once you are ready, you can request your lender to lock in the rate. Be sure to confirm the terms of the rate lock, including the duration and any associated fees.

What Happens During the Mortgage Application Process?

The mortgage application process involves several steps designed to verify your financial status and secure the best loan terms possible. Here’s an overview of the key stages:

Initial Application and Documentation

Start by filling out a mortgage application with your chosen lender. This will require providing detailed information about your financial situation, including income, assets, debts, and employment history. You will also need to submit various documents, pay stubs, tax returns, and bank statements, to support your application.

Loan Processing and Underwriting

After submitting your application, the lender begins the loan processing stage. During this phase, the lender verifies all the information you have provided and orders an appraisal of the property to determine its value. The underwriter then reviews your application and the appraisal to ensure that everything meets the lenders criteria. This step may involve requests for additional documentation or clarification on certain aspects of your application.

Final Approval and Closing

Once the underwriting process is complete and your loan is approved, you will proceed to the closing stage. During closing, you will sign all the necessary documents, pay any closing costs, Closing Costs: What Are They?, First-Time Home Buyers and provide your down payment. After the paperwork is finalized, you will receive the keys to your new home and officially become a homeowner.

What is Mortgage Underwriting and How Does it Work?

Mortgage underwriting is a critical step in the home loan process, where the lender assesses the risk of lending you money. Here’s an overview of how underwriting works:

Review of Financial Information

During underwriting, an underwriter thoroughly examines your financial documents to ensure you can afford the mortgage. This includes verifying your income, checking your employment status, and reviewing your bank statements and tax returns. The underwriter also looks at your credit score and history to evaluate your reliability in repaying debts. They assess your debt-to-income (DTI) ratio, which is the percentage of your monthly income that goes towards paying debts, to ensure you have sufficient cash flow to cover the mortgage payments.

Property Appraisal and Title Search

An essential part of underwriting is the appraisal process, where a professional appraiser evaluates the property to determine its market value. This ensures the loan amount does not exceed the properties worth, a title search is conducted to confirm that the property is free from any liens or legal claims. The results of the appraisal and title search can significantly impact the approval of your mortgage application.

Why is a Home Appraisal Important?

A home appraisal is an essential step in securing a mortgage, serving several critical functions:

Determining Property Value

The primary purpose of a home appraisal is to determine the properties market value. This assessment helps ensure that you, the buyer, are paying a fair price for the home. For lenders, it verifies that the property is worth the loan amount being requested. Appraisals are conducted by licensed professionals who evaluate the homes condition, size, location, and comparable sales in the area.

Protecting the Lender and Buyer

Appraisals protect both the lender and the buyer by preventing overborrowing. If the appraisal comes in lower than the purchase price, the lender might reduce the loan amount, and you may need to renegotiate the purchase price or cover the difference out of pocket. This step ensures that the lender is not taking on too much risk and that you are not overpaying for your new home.

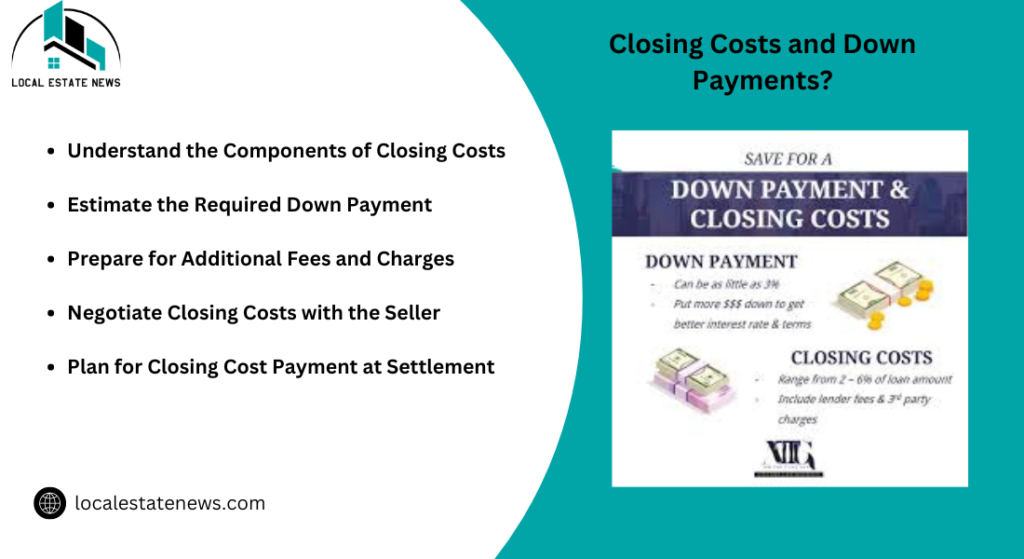

How to Prepare for Closing Costs and Down Payments?

Preparing for closing costs and down payments is an essential aspect of the home loan process. Here’s how you can effectively prepare:

Understanding Closing Costs

Closing costs are fees associated with finalizing your mortgage, which range from 2% to 5% of the loan amount. These costs can include appraisal fees, title insurance, attorney fees, and prepaid costs like property taxes and homeowners insurance. It is crucial to understand these fees and budget accordingly to avoid any surprises at closing. Your lender should provide a Loan Estimate document early in the process, detailing these costs.

Saving for the Down Payment

The down payment is a percentage of the homes purchase price that you pay upfront. The required amount varies depending on the type of loan and lender, ranging from 3% to 20%. For example, FHA loans require as little as 3.5%, while conventional loans might require up to 20%. Saving for a down payment can take time, so it is important to start early, set a savings goal, and explore options like down payment assistance programs if needed.

What to Expect on Closing Day?

Closing day is a key moment in the home buying process, marking the final step before you become a homeowner. Here’s what you can expect:

Review and Sign Documents

On closing day, you will review and sign a series of important documents, including the final closing disclosure, the deed of trust or mortgage, and the promissory note. The closing disclosure outlines the terms of your loan, including the loan amount, interest rate, and closing costs. It is crucial to compare this document with the Loan Estimate you received earlier to ensure there are no discrepancies. The deed of trust or mortgage grants the lender a lien on the property, and the promissory note is your binding agreement to repay the loan.

Transfer of Funds and Title

You will need to provide funds for the down payment and closing costs, through a wire transfer or cashiers check. The title company will then transfer the properties title to your name, ensuring that you are the legal owner of the home. This process may involve a title search to verify that the property is free from any liens or legal claims that could affect your ownership.

Common Mistakes to Avoid in the Home Loan Process

Navigating the home loan process can be complex, and there are several common mistakes that borrowers should avoid:

Not Getting Pre-Approved

One of the biggest mistakes is not getting pre-approved for a mortgage before starting your home search. Pre-approval gives you a clear understanding of your budget and shows sellers that you are a serious and qualified buyer. It also helps streamline the loan approval process once you find a home you want to buy.

Overlooking Additional Costs

Many homebuyers focus solely on the mortgage payment and overlook additional costs including property taxes, homeowners insurance, and private mortgage insurance (PMI). These costs can significantly impact your monthly budget and overall affordability. It is essential to factor in all potential expenses when calculating how much home you can afford.

How Long Does Each Step of the Home Loan Process Take?

The duration of each step in the home loan process can vary, but here’s a general timeline:

Pre-Approval

Getting pre-approved for a mortgage takes a few days to a week. This step involves submitting your financial information to a lender who will review your credit report, income, and assets to determine how much they are willing to lend you.

Loan Processing and Underwriting

The loan processing and underwriting phase usually takes two to four weeks. During this time, the lender verifies your financial information, orders a property appraisal, and conducts a detailed review of your loan application. This step may involve requests for additional documentation or clarification.

Closing

The closing process itself can take anywhere from a few days to a week, depending on the complexity of the transaction and any potential issues that arise. On closing day, you will sign the necessary documents, pay your closing costs, and receive the keys to your new home.

Different Types of Home Loans Available

When it comes to financing a home, there are several types of mortgage loans available, each tailored to different needs and financial situations. Here are some of the most common options:

Conventional Loans

Conventional loans are the most popular type of mortgage, not insured by the federal government. They require a higher credit score and a down payment of at least 3-20%. Conventional loans can be conforming or non-conforming, with conforming loans meeting the guidelines set by Fannie Mae and Freddie Mac. These loans are ideal for borrowers with a strong credit history and the ability to make a substantial down payment.

FHA Loans

Federal Housing Administration (FHA) loans are government-backed and designed for borrowers with lower credit scores and smaller down payments. You can qualify for an FHA loan with a credit score as low as 580 and a down payment of 3.5%. FHA loans are particularly popular among first-time homebuyers because of their flexible qualification requirements. They require mortgage insurance premiums, which can add to the overall cost of the loan.

VA Loans

Veterans Affairs (VA) loans are available to military service members, veterans, and eligible spouses. These loans are backed by the U.S. Department of Veterans Affairs and offer benefits, no down payment and no private mortgage insurance (PMI). VA loans typically have lower interest rates and are an excellent option for eligible borrowers looking to minimize upfront costs.

USDA Loans

The U.S. Department of Agriculture (USDA) offers loans to low- and moderate-income buyers in rural areas. USDA loans require no down payment and provide competitive interest rates, making homeownership more accessible to borrowers in eligible rural areas. However, there are income limits and property eligibility requirements to qualify for a USDA loan.

How to Handle Issues During the Home Loan Process

Navigating the home loan process can sometimes present challenges. Here’s how to handle common issues that may arise:

Dealing with Credit Issues

If you encounter problems with your credit score during the loan process, take immediate steps to address them. Obtain a copy of your credit report and check for errors. Dispute any inaccuracies and work on paying down existing debts to improve your credit score, avoid making large purchases or opening new credit accounts, as these actions can negatively impact your credit.

Addressing Appraisal Concerns

An appraisal that comes in lower than the purchase price can be a significant hurdle. If this happens, you have a few options: negotiate with the seller to lower the price, increase your down payment to cover the difference, or request a reconsideration of the appraisal if you believe there were errors. It is also helpful to provide the appraiser with recent comparable sales in the area to support the properties value.

Managing Documentation and Communication

Ensure all your documents are in order and respond promptly to any requests from your lender. Missing or incomplete documentation can delay the loan process. Keep open lines of communication with your lender, real estate agent, and other involved parties to address any issues quickly. Being proactive and organized can help smooth out potential bumps in the process.

Tips for First-Time Homebuyers Applying for a Home Loan

For first-time homebuyers, the mortgage process can be particularly daunting. Here are some tips to help:

Educate Yourself

Take the time to understand the different types of loans available and what each entails. Knowing the pros and cons of conventional, FHA, VA, and USDA loans can help you choose the best option for your situation. Use online resources and speak with a mortgage advisor to get a clear picture of your choices.

Get Pre-Approved

Obtaining pre-approval for a mortgage can give you a competitive edge when making an offer on a home. It shows sellers that you are a serious buyer and have the financial backing to follow through on a purchase. Pre-approval also provides a clear budget, helping you focus your home search on properties within your price range.

Plan for Additional Costs

First-time buyers often overlook the additional costs associated with buying a home, closing costs, property taxes, homeowners insurance, and maintenance expenses. Be sure to factor these into your budget to avoid financial surprises. Setting aside extra funds for these costs can ensure a smoother transition into homeownership.

Benefits of Getting Pre-Approved for a Mortgage

Getting pre-approved for a mortgage offers several advantages that can make your home buying process smoother and more efficient. Here are some key benefits:

Clear Budgeting and Financial Planning

A mortgage pre-approval gives you a clear picture of how much you can afford to borrow, which helps set a realistic budget for your home search. By knowing your approved loan amount, you can focus on properties within your price range, saving time and effort. This clarity prevents you from overextending your finances and ensures that you are looking at homes you can realistically afford.

Enhanced Negotiating Power

Being pre-approved for a mortgage enhances your credibility with sellers. It shows that you are a serious buyer with the financial backing to follow through on a purchase. This can be a significant advantage in competitive markets, where sellers may receive multiple offers. A pre-approval letter can make your offer more attractive and increase your chances of securing your desired property.

Faster Closing Process

Since much of the financial vetting is completed during the pre-approval process, the overall loan approval process can be expedited once you find a home and make an offer. This can lead to a quicker closing, allowing you to move into your new home sooner. A pre-approval can streamline the underwriting process, reducing the risk of last-minute surprises or delays.

How Can You Successfully Navigate the Home Loan Process?

Navigating the home loan process can seem daunting, but understanding each step can make it more manageable and less stressful. From pre-approval to closing, knowing what to expect helps ensure that you have prepared for each stage of the journey. This process typically starts with assessing your financial situation and determining how much you can afford using a mortgage calculator. This tool is invaluable as it helps you understand your financial boundaries and guides you toward selecting the right loan product.

An important steps is securing a pre-approval from your lender. Pre-approval not only gives you a clear idea of your budget but also makes you a more attractive buyer to sellers. Once pre-approved, you can start house hunting with confidence, knowing that you have the financial backing to make a strong offer. It is essential to gather all necessary documents and keep them organized, as this will be crucial during the underwriting process.

As you move forward, you will need to choose the right mortgage lender. This choice can impact your loans interest rate, fees, and overall affordability. After you have selected a lender, the process will enter the underwriting phase, where your financial details are scrutinized to ensure you qualify for the loan. Throughout this phase, staying responsive and providing any requested documents promptly will help keep things on track.

the process culminates in the closing stage, where you will review and sign all necessary documents, finalize your down payment, and officially become a homeowner. Anticipating each of these steps, you can navigate the home loan process more efficiently and with greater peace of mind.

and to calculate how much you can afford, consider using a mortgage calculator to guide your decisions from the start. This simple tool can provide clarity and direction, making your home buying journey smoother and more predictable.