How To Buy a House: Buying a house is most significant decisions you will make, and understanding the process step-by-step can make it more manageable. First, it is crucial to assess your financial situation. Start by determining your budget, which includes calculating how much you can afford for a down payment and monthly mortgage payments. You should also check your credit score, as it plays a significant role in qualifying for a mortgage. It is advisable to get pre-approved for a mortgage early on, which gives you a better idea of your budget and shows sellers that you’re a serious buyer.

Next, focus on finding the right location and home type that fits your lifestyle and future plans. Research neighborhoods, schools, and amenities to ensure they align with your priorities. You find a property that meets your needs, make an offer. This is usually done with the help of a real estate agent who will guide you through negotiations and paperwork. After the offer is accepted, you will need to conduct a home inspection and possibly renegotiate based on the findings. The final steps include securing your mortgage, completing the legal paperwork, and finally closing the deal to get the keys to your new home.

Key Points:

- Finalize your mortgage and complete legal formalities during closing

- Assess your budget and get a mortgage pre-approval

- Research neighborhoods and find a home that suits your needs

- Make an offer, negotiate, and complete the home inspection

What is the First Step, And how to buy a house?

The first step how to buy a house is to assess your financial situation. This involves evaluating your current income, expenses, savings, and credit score to determine what you can afford. Knowing your budget helps narrow down your search and prevents you from looking at buy a house that are out of your price range.

Start by examining your monthly income and expenses to see how much you can comfortably allocate toward a mortgage payment. Buy a house affordability calculator to get a rough estimate of the price range you should be considering. check your credit score and credit report. A higher credit score can qualify you for better mortgage rates, which can save you thousands of dollars over the life of the loan.

Consulting with a financial advisor or mortgage lender early in the process can provide you with a clearer picture of your financial health and help you make informed decisions, you move forward in the buy a house journey.

How Do You Determine Your Budget for Buying a House?

Determining your budget for buy a house, a house involves several key steps. First, calculate your monthly income and expenses to see how much you can afford to spend on a mortgage payment. A general rule of thumb is that your monthly mortgage payment should not exceed 25-30% of your gross monthly income.

Next, consider other costs associated with homeownership, property taxes, homeowners insurance, and maintenance costs. These expenses can add up quickly and should be factored into your budget. Use an online mortgage calculator to help you estimate these costs and see how different loan amounts and interest rates will affect your monthly payment.

Getting pre-approved for a mortgage can give you a clear idea of your budget. Pre-approval involves a lender reviewing your financial situation and providing you with a loan amount that you qualify for. This step not only helps you understand your budget but also strengthens your position as a serious buyer when you make an offer on a house.

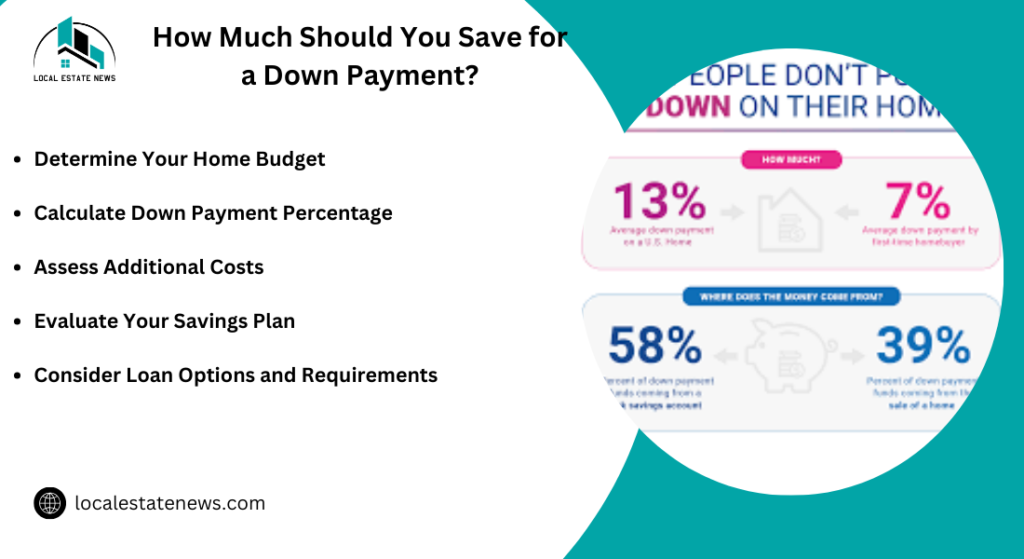

How Much Should You Save for a Down Payment?

The amount you should save for a down payment varies based on several factors, including the type of mortgage, the lender, and your financial situation. Traditionally, a 20% down payment is recommended because it can help you avoid paying for private mortgage insurance (PMI), which protects the lender if you default on the loan. However, many homebuyers, especially first-time buyers, opt for lower down payments.

Conventional loans may require as little as 3-5% down, while FHA loans require a minimum of 3.5% down. VA and USDA loans offer options with no down payment for eligible borrowers. It is essential that while a lower down payment can make homeownership more accessible, it also means higher monthly payments and additional costs like PMI.

To determine how much to save, start by setting a savings goal based on the buy a house price range you are considering. Use a down payment calculator to see how different down payment amounts will affect your monthly mortgage payments. Explore down payment assistance programs that may be available in your area to help you meet your savings goal faster.

your budget, exploring your financing options, and planning for your down payment, you can make the buy a house process smoother and more manageable. Stay informed and prepared to ensure you make the best financial decisions as you take off on this significant journey.

What Are Closing Costs and How Much Should You Budget for Them?

Closing costs are the fees and expenses you pay to finalize a mortgage. They range from 2% to 5% of the loan amount and can include various charges loan origination fees, appraisal fees, title insurance, and attorney fees. For a $300,000 home, this could mean paying between $6,000 and $15,000 in closing costs.

It is essential to understand what these costs cover to budget appropriately. Common closing costs include the appraisal fee, which ensures the homes value aligns with the loan amount, and the title search fee, which checks for any claims against the property. Other costs might include recording fees for updating public records, credit report fees, and potentially private mortgage insurance if your down payment is less than 20%.

To minimize closing costs, you can shop around for lenders, negotiate some of the fees, or ask the seller to contribute to your closing costs as part of the offer negotiation. Some states and local governments offer programs to help first-time homebuyers with these expenses.

Exploring your financing options, planning for your down payment, and preparing for closing costs, you can make the buy a house process smoother and more manageable. Stay informed and prepared to ensure you make the best financial decisions as you take off on this significant journey.

How Can You Improve Your Credit Score Before Buying a House?

Improving your credit score before buy a house is crucial, as it directly impacts your ability to qualify for a mortgage and the interest rate you will receive. Start checking your credit report for any errors and disputing inaccuracies. Ensuring that your credit report accurately reflects your financial situation can boost your score.

Pay down outstanding debts to improve your debt-to-income ratio. Focus on reducing balances on credit cards and loans. Keeping your credit utilization ratio (the amount of credit you use relative to your credit limit) low can significantly boost your score. Aim to keep your credit utilization below 30%.

Make all your payments on time, as payment history is the most significant factors affecting your credit score. Avoid opening new credit accounts or making large purchases on credit in the months leading up to your mortgage application, as this can temporarily lower your score.

According to your budget, exploring your financing options, planning for your down payment, preparing for closing costs, and improving your credit score, you can make the buy a house process smoother and more manageable. Stay informed and prepared to ensure you make the best financial decisions as you take off on this significant journey.

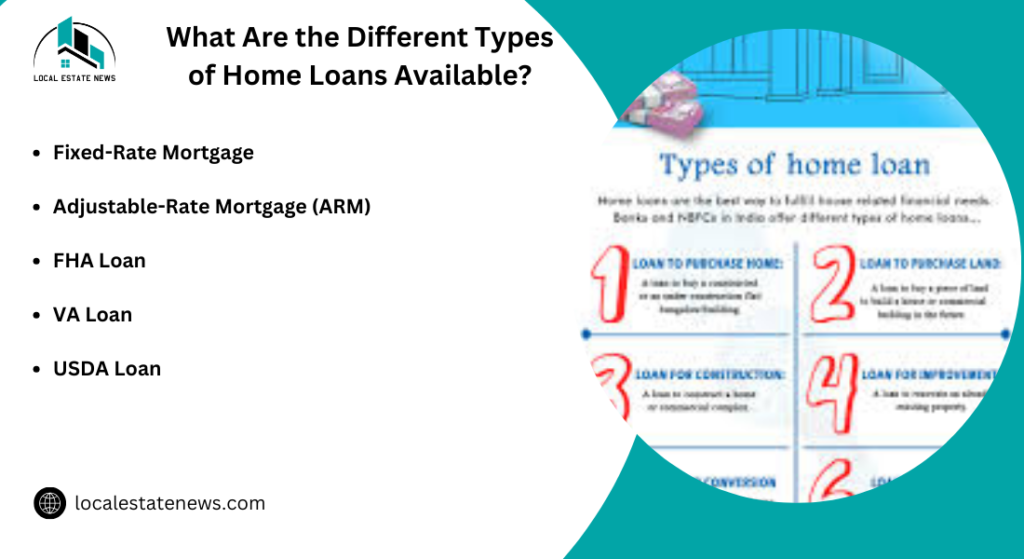

What Are the Different Types of Home Loans Available?

There are several types of home loans available, each with its own advantages and requirements:

- Conventional Loans: These are not insured the federal government and require a higher credit score and a down payment of at least 3-5%. They can be either fixed-rate or adjustable-rate mortgages. Conventional loans with less than 20% down payment generally require private mortgage insurance (PMI).

- FHA Loans: Insured the Federal Housing Administration, FHA loans allow for lower credit scores and down payments as low as 3.5%. They are popular among first-time homebuyers and those with lower credit scores. However, they require both upfront and annual mortgage insurance premiums .

- VA Loans: Available to veterans, active-duty service members, and eligible spouses, VA loans are backed the Department of Veterans Affairs. They offer benefits no down payment and no mortgage insurance, but they do have a funding fee that can be rolled into the loan.

- USDA Loans: These loans are backed the United States Department of Agriculture and are designed for low- to moderate-income buyers in eligible rural and suburban areas. They offer no down payment options and reduced mortgage insurance premiums.

- Jumbo Loans: These loans are for properties that exceed the conforming loan limits set Fannie Mae and Freddie Mac. They require higher credit scores and larger down payments but can finance higher-priced properties.

How Do You Get Pre-Approved for a Mortgage?

Getting pre-approved for a mortgage is an important step in the buy a house process that shows sellers you are a serious buyer. To get pre-approved, you will need to complete a mortgage application and provide the lender with documentation to verify your financial status.

First, gather all necessary documents, including proof of income (pay stubs and tax returns), proof of assets (bank statements and investment accounts), and personal identification. Lenders will also check your credit history and credit score. Ensure your credit report is accurate and correct any errors before applying.

Next, submit your application to multiple lenders to compare rates and terms. The lender will review your financial information and issue a pre-approval letter, which states the loan amount you are approved for, along with other terms and conditions. This letter is valid for a certain period, usually 60 to 90 days, and strengthens your position when making an offer on the house.

Your budget, exploring your financing options, planning for your down payment, preparing for closing costs, improving your credit score, and getting pre-approved for a mortgage, you can make the buy a house process smoother and more manageable. Stay informed and prepared to ensure you make the best financial decisions as you take off on this significant journey.

How to Create a Home Wish List: What Should You Include?

Creating a home wish list is an essential step in the buy a house process, helping you identify your needs and wants in a property. Start fantasizing about your ideal home and jotting down everything you envision. This includes the type of home, its style, and specific features the number of bedrooms, bathrooms, and whether you want a large yard or a central location.

Once you have your dream list, categorize items into three groups: needs, wants, and wishes. Needs are non-negotiable features, a specific number of bedrooms or proximity to work. Wants are features you would like but could live without, like a swimming pool or a large kitchen. Wishes are luxury items that would be nice to have but are not essential.

Consider the input of everyone who will live in the home to ensure all priorities are included. This process helps you stay focused and organized during your house hunt and ensures you find a home that meets your most important criteria.

What Factors Should You Consider When Choosing a Location?

Choosing the right location for your new home is crucial as it impacts not only your daily life but also the long-term value of your investment. Here are some key factors to consider:

- Proximity to Essential Amenities: Most important aspects is the proximity to essential services and amenities. Look for locations that are near grocery stores, schools, hospitals, and public transportation. Having easy access to these services can significantly improve your quality of life and increase the desirability of the area.

- Safety and Neighborhood Quality: Safety is a top priority for many homebuyers. Research the crime rates in the area and visit the neighborhood at different times of the day to get a sense of its safety. The quality and upkeep of the neighborhood can provide insights into the communities pride of ownership and stability.

- Commute and Transportation: Consider the commute times to your workplace and other frequently visited places. Long commutes can add stress and reduce the time available for personal activities. Areas with good public transportation options can offer more flexibility and potentially lower transportation costs.

How to Find the Right Real Estate Agent?

Finding the right real estate agent is crucial to navigating the Buy a house process efficiently and successfully. Here are some key steps to ensure you choose the best agent for your needs:

- Gather Referrals and Do Online Research: Start asking friends, family, and colleagues for referrals. However, don’t rely solely on their recommendations. Look up the agents’ websites and online profiles, read about their specialties, and check customer reviews. Utilize online tools like Realtor.com Find a Realtor search to gather useful information about potential agents, their years of experience, the number of homes sold, and the typical price range of properties they deal with.

- Interview Multiple Agents: It is important not to settle on the first agent you come across. Interview at least three agents to compare their experience, approach, and communication style. During the interview, ask key questions like:

- How long have you been in real estate?

- How familiar are you with the local market?

- What is your strategy for buy a house or selling homes?

- Can you provide references from past clients?

- How do you handle multiple offers and negotiate on behalf of your clients?

- Evaluate Their Communication Skills and Availability: Effective communication is essential in real estate transactions. Test their responsiveness sending an email or making a call and observing how quickly they respond. Ensure they are available to meet your schedule, especially if you need to view properties or discuss offers frequently.

What Should You Look for During Home Inspections?

A thorough home inspection is essential to identify any potential issues before finalizing your home purchase. Here are the key areas you should focus on during a home inspection:

- Structural Integrity and Exterior: The first step is to examine the homes exterior and structural condition. Inspect the foundation for cracks, settling, or water damage. Check the roof for missing shingles, leaks, or signs of wear that might require replacement. The siding, gutters, and downspouts should be in good condition to prevent water damage. Ensure that windows and doors are properly sealed to avoid drafts and water intrusion. Inspect the grading around the house to ensure water drains away from the foundation.

- Major Systems and Safety Issues: Inside the home, the inspector will examine critical systems plumbing, electrical, HVAC (heating, ventilation, and air conditioning), and appliances. Look for signs of leaks or water damage in the plumbing system, and ensure the water heater is functioning correctly. Electrical panels, outlets, and switches should be in good working order, with no exposed wiring or overloaded circuits. The HVAC system should be operational and well-maintained. The inspector will check for safety issues like radon, asbestos, lead paint, and pest infestations, which could pose health risks and require costly remediation.

How Do You Make an Offer on a House?

Making an offer on a house is a critical step in the buy a house process. Here are the essential steps to ensure your offer stands out and aligns with your budget and goals:

- Research and Preparation: Before making an offer, work closely with your real estate agent to understand the local market conditions and determine a fair offer price. Your agent can provide a Comparative Market Analysis (CMA) to help you gauge the value of similar properties in the area. Ensure you are pre-approved for a mortgage, as this strengthens your position and shows the seller that you are a serious buyer.

- Drafting the Offer: Your offer should include the address and description of the property, the proposed purchase price, and any contingencies financing and home inspection. Specify the amount of earnest money you are willing to put down to demonstrate your commitment. This money is held in escrow and applied to your down payment if the offer is accepted. Be sure to set a reasonable time frame for the seller to respond to your offer and outline any specific terms you require, the inclusion of certain appliances or a specific closing date.

What Happens After Your Offer is Accepted?

- Apply for a Mortgage: If you haven’t already been pre-approved for a mortgage, this is the time to formally apply. Even if pre-approved, you’ll need to finalize your loan application. Choose a lender and submit the necessary documentation to secure your mortgage. This includes income verification, credit history, and other financial details.

- Conduct a Home Inspection and Appraisal: Schedule a home inspection as soon as possible. A professional inspector will evaluate the properties condition, checking for structural issues, electrical problems, plumbing defects, and more. Any significant issues discovered can be grounds for renegotiation with the seller. Simultaneously, your lender will require a home appraisal to ensure the properties value aligns with the loan amount. If the appraisal is lower than the purchase price, you may need to negotiate a lower price or cover the difference out of pocket.

- Secure Homeowners Insurance: Before closing, you must obtain homeowners insurance to protect your investment and satisfy your lenders requirements. Shop around for the best rates and coverage options, ensuring you have the necessary protections, including any additional coverage for natural disasters if needed. Provide proof of insurance to your lender to avoid any delays in the closing process.

How to Prepare for the Closing Process?

Preparing for the closing process in a real estate transaction is crucial to ensure a smooth and successful transfer of property ownership. This stage involves several key steps that require careful attention to detail. Start reviewing and all the closing documents you will encounter, including the settlement statement, the deed, and any loan documents. It is essential to ensure that all the information is accurate and aligns with the terms agreed upon in the purchase contract. For instance, verify that the purchase price, closing costs, and any adjustments or credits are correctly reflected.

Make sure to secure the necessary funds for closing, which includes the down payment, closing costs, and any prepaid items property taxes and insurance. Your lender will often provide a closing disclosure that outlines these costs, giving you a clear picture of what you’ll need to bring to the closing table. It is advisable to confirm these details with your real estate agent or attorney well in advance of the closing date to Avoid any last-minute surprises. Ensure that you have completed any required inspections, appraisals, or repairs as stipulated in the contract. meticulously preparing and staying organized, you can help facilitate a smooth closing process and transition into your new property with confidence.

What Are the Final Steps in Closing on a House?

The final steps in closing buy a house, for finalizing the property transfer and ensuring that all legal and financial aspects are properly addressed. The key steps involves conducting a final walk-through of the property. This is scheduled shortly before the closing date to ensure that the property is in the agreed-upon condition and that any repairs or changes have been completed as stipulated in the contract. During this walk-through, it is important to check that all fixtures, appliances, and systems are in working order and that no new issues have arisen since the last inspection. Cookies Policy

Closing Meeting and Final Steps

- Closing Meeting: The legal transfer of ownership occurs here.

- Documents to Review and Sign: Includes closing disclosure, deed of trust, and mortgage note.

- Payment: Provide a certified or cashier’s check for the remaining funds (down payment, closing costs, additional fees).

- Transfer and Recording: Funds are transferred and the deed is recorded with the local government.

- Final Steps: Ensure receipt of copies of signed documents and final settlement statement; complete the transaction and take possession of your new home.

Conclusion

Buy a house is a multifaceted process that involves careful planning, diligent research, and precise execution. From securing financing and finding the right property to solving the problem of the closing process, each step plays an important role in achieving a successful home purchase. And preparing for each phase whether it is getting pre-approved for a mortgage, making an informed offer, or ensuring a smooth closing you set yourself up for a more streamlined and satisfying experience.

the key to a successful home purchase lies in thorough preparation and proactive management of each stage of the process. Staying organized, seeking professional advice, and maintaining clear communication with all parties involved, you can navigate the challenges of buy a house with greater ease. This inclusive approach not only helps in securing a home that meets your needs and budget but also ensures a positive transition into homeownership. As you move forward, remind every step you take brings you closer to achieving your dream of owning a home.