Real estate commissions are a fundamental part of the home buying and selling process, serving as the primary means of compensation for real estate agents. Understanding how these commissions work is crucial for both buyers and sellers, as it directly impacts the cost and success of a property transaction. Calculated as a percentage of the properties sale price, real estate commissions cover a wide range of services provided by both the listing agent and the buyers agent. These services are essential to navigating the complexities of the real estate market, ensuring that transactions are completed smoothly and efficiently.

- Realtor fees

- commission structure

- real estate agent commission

- buyers agent

- listing agent

- broker fees

- commission split

What are real estate commissions and how are they calculated?

Real estate commissions are calculated as a percentage of the final sale price of a property. In the United States, this percentage generally ranges from 5% to 6%, though it can vary depending on the region, the type of property, and the specific agreement between the seller and the real estate agents involved. The total commission is usually split between the listing agent, who represents the seller, and the buyer’s agent, who represents the buyer.

For example, if a home sells for $300,000 with a 6% commission, the total commission would amount to $18,000. This sum is then divided equally between the two agents, giving each a $9,000 share, this amount is further divided between the agents and their respective brokers, who may take a significant portion of the commission depending on the contractual agreement. This split compensates the brokers for providing office space, resources, and liability coverage.

Real estate commissions are often factored into the cost of selling a property, with sellers paying the commission out of the proceeds from the sale. It is essential for both buyers and sellers to understand how these fees are calculated, as they significantly impact the net proceeds of a sale and the overall cost of purchasing a property

How do listing agents earn their commission?

Listing agents earn their commission by providing a range of services designed to market and sell a property effectively. The process begins with a thorough market analysis, where the agent evaluates comparable sales in the area to determine a competitive listing price. This is crucial for attracting potential buyers while maximizing the seller’s profit, listing agents often suggest improvements or staging techniques to enhance the property’s appeal, which can be instrumental in achieving a higher selling price.

Beyond setting the price, listing agents are responsible for creating a comprehensive marketing strategy. This includes listing the property on multiple platforms, organizing open houses, and using professional photography and virtual tours to showcase the home. These efforts are aimed at reaching a broad audience and generating as much interest as possible. The listing agent also plays a critical role in negotiating offers, ensuring that the seller gets the best possible deal by leveraging their market knowledge and negotiation skills.

Listing agents manage the transaction process, coordinating with buyers, attorneys, inspectors, and other professionals to ensure that the sale proceeds smoothly. This involves handling all necessary paperwork, meeting legal requirements, and resolving any issues that may arise during the closing process. The commission earned by listing agents is a reflection of the extensive work they do to bring a sale to completion.

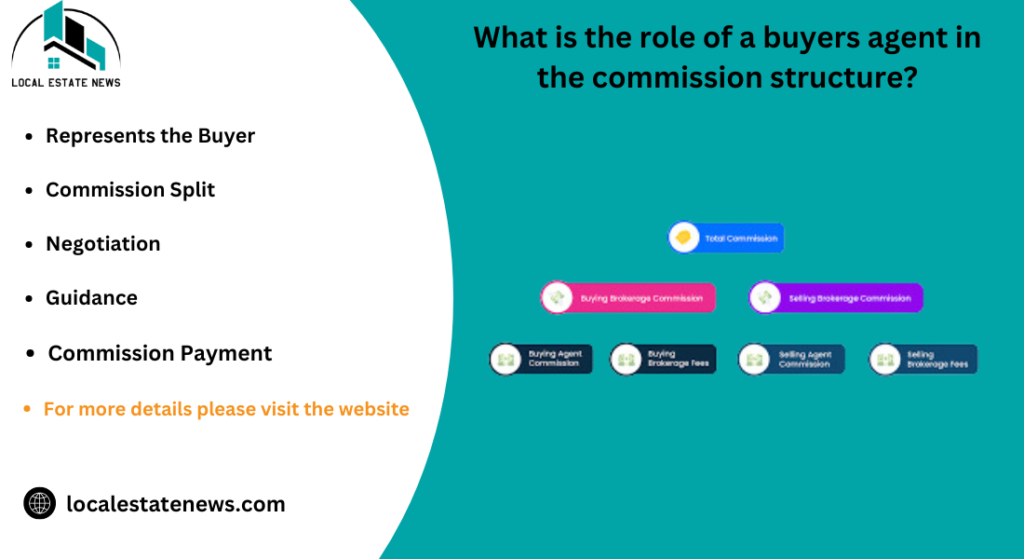

What is the role of a buyers agent in the commission structure?

A buyers agent plays a critical role in the real estate commission structure by representing the interests of the buyer throughout the home purchasing process. Their primary responsibility is to help buyers find properties that meet their needs and budget. This involves conducting property searches, arranging viewings, and providing valuable insights into the local market conditions. By doing so, buyer’s agents help their clients make informed decisions when selecting a property.

A buyer has identified a property of interest, the buyers agent assists in negotiating the purchase price and terms of the sale. They leverage their market expertise to ensure that the buyer pays a fair price for the property, often saving the buyer money in the process. The agent also helps navigate the complexities of the purchase agreement, ensuring that the buyer’s interests are protected in the contract.

The buyers agents commission, around 2.5% to 3% of the home’s sale price, is usually paid by the seller as part of the overall real estate commission. This means that buyers benefit from professional representation without having to pay out of pocket for the agents services. The commission incentivizes buyers agents to work diligently on behalf of their clients, guiding them through one of the most significant financial transactions of their lives.

Why does the seller typically pay the buyer’s agent’s commission?

The seller pays the buyer’s agent’s commission as part of the broader real estate commission structure. This practice is rooted in the tradition of making the home buying process as seamless as possible for the buyer, who often faces significant expenses such as securing financing, making a down payment, and covering closing costs. By covering the buyers agent’s commission, the seller helps to alleviate some of these financial burdens, potentially making the property more attractive to prospective buyers.

Paying the buyers agents commission serves as an incentive for buyer’s agents to bring clients to view and potentially purchase the property. Since the buyers agents compensation is tied to the successful sale of the home, this structure encourages agents to actively promote the property to their clients. This can lead to a faster sale and a higher likelihood of receiving competitive offers, benefiting the seller in the long run.

This commission structure is also advantageous because it aligns the interests of all parties involved. The seller wants to sell the home quickly and at the best possible price, the buyer wants to secure a good deal, and the buyer’s agent is motivated to close the sale efficiently. By handling the commission for both agents, the seller facilitates a smoother transaction process and helps ensure that all parties work collaboratively towards a successful sale

What services are included in a real estate agent’s commission?

The commission that a real estate agent earns is designed to cover a broad range of services that are essential to successfully selling or buying a home. These services start with pricing the property correctly by conducting a thorough market analysis. The agent uses their expertise to determine a competitive yet realistic price that attracts buyers without undervaluing the property. This initial pricing decision is critical, as overpricing can lead to a prolonged listing and underpricing can result in lost profit.

Next, agents provide marketing services that are crucial for attracting potential buyers. These include creating professional listings, taking high-quality photographs, staging the home, and promoting the property through various channels, including online real estate platforms, social media, and traditional advertising. Advanced marketing efforts might also involve virtual tours and open house events, all aimed at showcasing the property to a wide audience.

Agents manage the negotiation process once offers start coming in. They help their clients assess the strength of each offer, negotiate terms, and handle counter offers to ensure the best possible outcome. This negotiation extends beyond just the price and includes managing requests for repairs or concessions that might arise after home inspections, real estate agents also guide their clients through the closing process, ensuring all paperwork is completed correctly and coordinating with other professionals, such as inspectors and title companies, to finalize the sale smoothly.

Can real estate commissions be negotiated?

Yes, real estate commissions are negotiable, and the exact terms can vary depending on several factors, including the specific transaction, market conditions, and the services required. While the standard commission rates typically range between 5% and 6%, sellers and buyers can discuss these fees with their agents to reach an agreement that reflects the scope of work involved. For example, an agent might be willing to lower their commission if the property is expected to sell quickly or if the agent is representing both the buyer and the seller in a transaction (a situation known as dual agency).

It is important to understand that negotiating a lower commission might impact the level of service you receive. A reduced commission could mean a smaller budget for marketing and other essential services, which might affect the agent’s ability to sell the home quickly and at the best possible price. It’s crucial to weigh the potential savings against the value and expertise an agent brings to the transaction.

What are the common misconceptions about real estate commissions?

One of the most common misconceptions about real estate commissions is that they are non-negotiable. In reality, commission rates are not fixed and can be negotiated depending on the situation. Another misconception is that a lower commission always results in more savings for the seller. While a reduced commission might save money upfront, it could also mean receiving fewer services, which can negatively impact the sale price and overall outcome of the transaction.

Many people believe that commissions are a significant expense that primarily benefits the agent. This fee compensates agents for a wide range of services that are crucial to the transactions success, including marketing the property, negotiating terms, and managing the complex logistics of closing a deal. Understanding these misconceptions can help sellers and buyers make more informed decisions when working with real estate agents. Real Estate Trends

These sections aim to provide clarity on important aspects of real estate commissions, using a strategic and informed approach to ensure readers understand the value and flexibility of commission structures. By addressing common questions and myths, this content aligns with the Koray framework, enhancing topical authority and providing responsive, relevant information.

How do commission splits between agents and brokers work?

Commission splits between agents and brokers are a key component of how real estate professionals are compensated. When a property is sold, the total commission is first divided between the listing agent and the buyer’s agent, each agent receives about half of the total commission, the commission split doesn’t end there; each agent must then share their portion with their respective broker. This split is often necessary because brokers provide the infrastructure and support agents need to operate, such as office space, administrative assistance, and legal protection. agents and brokers work

The exact percentage of the split between an agent and their broker can vary depending on the agreement between them. For newer agents, the split might be more heavily weighted in favor of the broker, such as 50/50, due to the additional support and resources the broker provides. Experienced agents, on the other hand, might negotiate a more favorable split, such as 70/30 or even 80/20, where the agent retains a larger portion of the commission.

In some cases, especially in larger real estate firms, brokers might offer agents different commission structures based on their level of production. High-performing agents might be offered a higher split as an incentive, while newer or lower-producing agents might accept a lower split in exchange for more guidance and support from the broker. Understanding these splits is crucial for agents to maximize their income and for clients to understand where their money is going.

Are real estate commissions different across various markets?

Real estate commission rates can vary significantly across different markets, influenced by local customs, the average home price in the area, and the level of competition among real estate agents. In most of the United States, commission rates typically range between 5% and 6% of the home’s sale price, in some highly competitive urban markets, agents might be willing to negotiate lower commissions, especially if the property is expected to sell quickly or if the transaction volume is high.

In less competitive or rural markets, where properties might take longer to sell, agents might stick more closely to the traditional 6% commission rate to ensure they are adequately compensated for their efforts, luxury markets or regions with higher average home prices might see slightly lower percentage rates, as even a small percentage of a multimillion-dollar sale can result in a substantial commission.

It is also important to note that some markets are beginning to see alternative commission models, such as flat fees or discount brokerages offering lower rates for reduced services. These models are becoming more common as technology changes how homes are marketed and sold, providing more options for both sellers and buyers in different regions.

How might changes in commission regulations impact real estate transactions?

Recent developments in real estate commission regulations, particularly following high-profile lawsuits and settlements, could lead to significant changes in how commissions are structured and who pays them, the seller has paid both the listing and buyers agent’s commissions, ongoing legal challenges argue that this practice inflates costs and reduces transparency, potentially leading to a shift where buyers might be more responsible for paying their agents directly.

If these changes take hold, the impact on real estate transactions could be profound. Buyers might become more selective about hiring agents, leading to greater price competition among agents for their services. Sellers, on the other hand, might be relieved of the burden of paying the buyer’s agent’s commission, which could lower their overall costs. This shift could also complicate transactions, as buyers would need to account for these additional costs when budgeting for a home purchase.

These regulatory changes might encourage more innovative commission models, such as performance-based commissions or tiered pricing structures. As the market adapts to these new rules, both buyers and sellers will need to be more informed about the costs associated with hiring a real estate agent and how these fees might affect their overall transaction.

These sections provide comprehensive insights into the complexities of real estate commissions, aligned with the Koray framework to ensure the content is authoritative, relevant, and responsive to user queries.

How can understanding real estate commissions help in buying or selling a home?

Real estate commissions play a crucial role in the buying and selling process, serving as the primary means of compensation for agents who facilitate these complex transactions. Understanding how these commissions are calculated, the services they cover, and the various factors that influence them is essential for both buyers and sellers. Commissions typically range from 5% to 6% of the sale price and are split between the buyer’s and seller’s agents, these rates can vary based on regional market conditions, the property type, and the specific agreements made between agents and their clients. Pricing your home in details guided

As the real estate industry evolves, driven by changes in technology and regulation, the traditional commission structure may continue to adapt. Whether it is through negotiated rates, alternative commission models, or the potential shift in who pays these fees, staying informed about these developments is crucial for anyone involved in a real estate transaction. By understanding the full scope of services provided by real estate agents and how commissions are structured, both buyers and sellers can make more informed decisions, ensuring they receive the best value and support throughout their real estate journey.

This conclusion encapsulates the importance of real estate commissions in the overall transaction process, highlighting the need for both awareness and adaptability as the market continues to change.