Starting on the journey of becoming a first-time home buyer is both exciting and overwhelming. This milestone represents a significant step toward building equity and securing a place to call your own, the process involves more than simply finding your dream home. It requires careful planning, financial preparation, and an understanding of various nuances of the real estate market. This guide aims to provide Complete insights and practical tips to help you navigate the complexities of home buying, ensuring you make informed decisions that align with your long-term goals.

What financial steps should first-time home buyers take before house hunting?

Before you even start browsing real estate listings, it’s crucial to assess your financial health. This means taking a close look at your credit score, which plays a major role in securing a favorable mortgage rate. A higher score will lead to lower interest rates, meaning less money paid over the lifetime of your loan. First, check your credit report for any errors and pay down debts to improve your score. Next, consider your budget. How much house can you realistically afford? This isn’t just about the mortgage payments; remember to account for property taxes, insurance, and potential homeowners’ association fees.

How can first-time home buyers improve their credit score?

Improving your credit score is one of the most effective ways to secure better mortgage terms. Start by paying down any existing debt and ensuring all your bills are paid on time. Regularly monitor your credit report to correct any inaccuracies that might be dragging your score down. Maintaining low balances on your credit cards and avoiding new debt can also positively impact your score. Financial health is key to getting the best possible mortgage rates and terms.

What are the budgeting strategies for first-time home buyers?

Creating a realistic budget is essential for any first-time home buyer. Begin by determining your monthly income and expenses to understand how much you can afford to spend on a home. Experts often recommend that your home cost should not exceed three times your annual income, it is wise to get pre-approved for a mortgage to understand what you can afford and to show sellers you are a serious and ready buyer. Consider all costs involved in homeownership, including property taxes, homeowners insurance, and maintenance expenses.

What pre-approval steps should first-time home buyers follow?

Getting pre-approved for a mortgage gives you a clear understanding of your budget and makes you a more attractive buyer to sellers. To get pre-approved, you will need to provide your lender with various financial documents, including proof of income, tax returns, and details of any debts or assets. This process helps you know how much you can borrow and at what interest rate. It also demonstrates to sellers that you are serious and financially prepared to buy a home.

How to understand and navigate the real estate market as a first-time home buyer?

The real estate market can be complex and varies widely depending on the location and economic conditions. Understanding market dynamics, interest rates, housing supply, and seasonal trends can help you make a more informed decision. Working with a local real estate agent who has a strong track record can provide invaluable insights into market conditions and help you find homes that meet your needs and budget.

What are the benefits of using a real estate agent for first-time home buyers?

A knowledgeable real estate agent can be an invaluable asset for first-time home buyers. They can provide insights into local market conditions, help you find homes that match your criteria, and negotiate on your behalf. Real estate agents can also guide you through the complexities of making an offer, handling inspections, and closing the deal. Their expertise can save you time, stress, and potentially even money.

How do home warranties benefit first-time home buyers?

Home warranties can provide peace of mind by covering the costs of repairs for major systems and appliances that might break down after you move in. This can be particularly beneficial for first-time home buyers who might not be familiar with the intricacies of home maintenance. A good home warranty can safeguard against unexpected expenses, making the transition into homeownership smoother and more secure.

“first-time home buyer” such as financial health, credit score, property taxes, homeowners insurance, maintenance expenses, interest rates, and real estate market, ensuring the article is optimized for search engines while providing valuable information for readers.

What are the key components of making an offer on a home?

Making an offer on a home is a critical step in the home-buying process, and it involves several key components to ensure your bid stands out to sellers.

Purchase Offer Details

Your purchase offer, if accepted, becomes a binding sales contract. It must include all necessary details to serve as a blueprint for the final sale. These components typically include:

- Property Details: The address and a legal description of the property.

- Sale Price: The amount you are willing to pay for the home.

- Terms: Whether it’s an all-cash transaction or subject to you obtaining a mortgage.

- Earnest Money: A deposit showing your serious intent to buy, typically 1% to 3% of the sale price.

- Contingencies: Conditions that must be met for the sale to proceed, such as financing and home inspection.

- Closing Date: The proposed date for finalizing the sale.

Contingencies and Flexibility

Contingencies are conditions included in your offer that must be met for the sale to go through. Common contingencies involve:

- Financing: Ensuring you can secure a mortgage.

- Home Inspection: Allowing you to back out if the inspection reveals significant issues.

- Sale of Current Home: Sometimes necessary if your purchase depends on selling your current home.

Flexibility in contingencies can make your offer more attractive. For instance, in a competitive market, minimizing contingencies might make your offer stand out. Offering a flexible closing date can also appeal to sellers who need more time to move out.

Personal Touches and Competitive Strategies

Adding a personal touch, such as a cover letter explaining why you love the home, can help create an emotional connection with the seller. While this isn’t always effective or even permissible in all markets, it can sometimes make a difference in a competitive scenario.

Being prepared to handle your own closing costs or offering to pay a portion of the sellers closing costs can make your offer more appealing. Including an escalation clause, where you automatically increase your bid if outbid, can also help in competitive situations.

How to handle negotiations and counteroffers in the home-buying process?

Negotiations are a crucial part of the home-buying process. Once you make an offer, the seller can accept it, reject it, or counter it with their own terms.

Responding to Counteroffers

When the seller counters your offer, they might change the price or terms. You can then accept, reject, or counter the counteroffer. This negotiation can continue until both parties agree on the terms. Having a skilled real estate agent can be invaluable during this phase, as they can advise you on the best strategies and help you understand the sellers priorities.

Strategies for Effective Negotiation

To negotiate effectively:

- Know Your Limits: Understand your budget and what you can afford.

- Be Ready to Compromise: Decide which aspects of the offer are most important to you and where you can be flexible.

- Stay Calm and Patient: Negotiations can take time, and it is essential to stay composed and patient throughout the process.

Common Negotiation Tactics

- Price Adjustments: Based on market conditions and the properties value.

- Requesting Repairs: If the home inspection reveals issues, you might ask the seller to make repairs or reduce the sale price.

- Flexible Closing Dates: Accommodating the sellers timeline can make your offer more appealing.

Why are home inspections crucial for first-time home buyers?

Home inspections are Essential for first-time home buyers as they provide an in-depth evaluation of the properties condition. This step helps ensure there are no hidden issues that could result in costly repairs down the line.

Identifying Potential Issues

A thorough home inspection will cover major systems and components of the home, such as the roof, foundation, plumbing, electrical systems, and HVAC. Identifying potential issues early allows you to address them before finalizing the purchase, either by requesting repairs, negotiating a lower price, or deciding not to proceed with the purchase.

Negotiating Based on Inspection Results

If the inspection reveals significant problems, you have the leverage to renegotiate the terms of the sale. You might ask the seller to make necessary repairs or provide a credit towards closing costs to cover the repair expenses. This step ensures you are making a sound investment and not inheriting unexpected problems.

Peace of Mind

For first-time home buyers, a home inspection provides peace of mind. Knowing that the property has been professionally evaluated and that any issues have been identified and addressed can make the transition to homeownership smoother and less stressful.

These steps, from making a solid offer to handling negotiations and understanding the importance of inspections, form the foundation of a successful home-buying experience. By being well-prepared and informed, first-time home buyers can navigate the process confidently and make decisions that best suit their needs and financial situation.

What should first-time home buyers expect during the appraisal process?

The home appraisal process is a crucial step in securing a mortgage and involves several detailed evaluations to determine the properties fair market value.

Steps in the Appraisal Process

- Initial Research: The appraiser begins by noting the address, whether the home is rented, owner-occupied, or vacant, and reviewing the sales contract to understand the offered price. They also consider the neighborhood and property values of nearby homes, which can significantly influence the appraisal value.

- Home Walkthrough: During the walkthrough, the appraiser assesses the condition of the home, both inside and out. Key factors include the number of rooms, availability of windows and closets, and the condition of major systems like HVAC and electrical. The appraiser also notes any health and safety issues, such as the presence of lead paint, especially if the buyer is using an FHA or VA loan, which may require certain repairs to be made.

- Comparable Sales (Comps): The appraiser identifies comparable properties that have recently sold in the area, matching as closely as possible in terms of structure, features, and location. These comps help determine if the sale price of the home aligns with the market value. This process ensures the appraisal is based on relevant and recent data.

- Formal Report: Finally, the appraiser compiles all the findings into a formal report, typically using the Uniform Residential Appraisal Form. This report includes photographs of the property, a detailed explanation of how the value was calculated, market sales data, and any public land or tax records considered during the evaluation.

Possible Outcomes

- Valuation Matches or Exceeds Offer Price: If the appraised value meets or exceeds the offer price, the lender will proceed with underwriting the loan. This outcome is ideal and allows the home buying process to continue smoothly.

- Valuation Below Offer Price: If the appraised value is lower than the offer price, it can complicate the purchase. The lender will not loan more than the appraised value, potentially leaving a shortfall. In such cases, buyers can renegotiate the price with the seller, seek a new appraisal, or cover the difference themselves.

What are the essential maintenance tips for new homeowners?

Transitioning into homeownership involves taking on various maintenance responsibilities to ensure the property remains in good condition and retains its value over time.

Regular Upkeep

- Seasonal Maintenance: Prepare your home for different seasons by performing tasks like cleaning gutters, checking the heating system, and sealing drafts around windows and doors before winter. Regularly maintaining these areas helps prevent costly repairs and keeps your home comfortable throughout the year.

- Inspect Major Systems: Regularly inspect and service major systems such as HVAC, plumbing, and electrical systems. This includes changing air filters, checking for leaks, and ensuring electrical panels are functioning correctly. Keeping these systems in good working order prevents breakdowns and extends their lifespan.

- Exterior Care: Maintain the exterior of your home by checking the roof for damage, cleaning out gutters, and inspecting the foundation for cracks. Also, take care of your yard by trimming trees, maintaining landscaping, and ensuring proper drainage away from the house to prevent water damage.

Preventive Measures

- Pest Control: Regularly check for signs of pests and take preventive measures to keep them out of your home. This includes sealing cracks and gaps, keeping food sealed, and maintaining clean and dry environments in basements and attics.

- Safety Checks: Ensure your home is safe by checking smoke and carbon monoxide detectors, maintaining fire extinguishers, and having a family emergency plan in place. Regularly test these devices and replace batteries as needed to ensure they function properly when needed.

How to close the deal on a home purchase?

Closing the deal on a home purchase is the final step in the buying process and involves several key actions to ensure a smooth transition into homeownership.

Final Steps

- Final Walkthrough: Before closing, conduct a final walkthrough of the home to ensure it is in the agreed-upon condition and that any requested repairs have been completed. This step helps confirm that there are no unexpected issues with the property.

- Closing Costs and Documents: Prepare to pay closing costs, which can include fees for the loan origination, appraisal, home inspection, and title insurance. Review all closing documents carefully, including the closing disclosure, which outlines the terms of your loan, final closing costs, and the amount you need to bring to the closing.

- Signing and Transfer: At the closing meeting, you will sign numerous documents, including the mortgage agreement and the deed. Once all documents are signed and the lender releases the funds, the title of the property is transferred to you. Make sure to keep copies of all documents for your records.

Post-Closing Actions

- Change of Ownership: After closing, ensure utilities and services are transferred to your name. This includes electricity, water, gas, internet, and any other services you will need in your new home.

- Homeowners Insurance: Make sure your homeowners insurance policy is active from the day of closing. This insurance protects your new investment and is typically required by lenders.

By understanding the appraisal process, maintaining your new home, and carefully navigating the closing process, you can ensure a smooth transition into homeownership and protect your investment for years to come.

What are the key considerations for moving into a new home?

Moving into a new home is a significant milestone that involves careful planning and organization to ensure a smooth transition. Here are some essential considerations to keep in mind:

Preparing for the Move

- Packing and Supplies: Start by gathering packing supplies like boxes, tape, bubble wrap, and markers. Label each box with its contents and the room it belongs to, which will make unpacking easier. Begin packing non-essential items early to avoid last-minute stress .

- Hiring Movers or Renting a Truck: Research and hire a reputable moving company or rent a truck if you plan to move yourself. Get quotes from at least three providers to ensure you are getting a fair price. Make sure to confirm all details, including the date and time of the move, and check the companies licensing and insurance coverage.

- Setting Up Utilities and Services: Contact your utility providers to schedule the disconnection of services at your old home and the setup of services at your new one. This includes electricity, gas, water, internet, and waste management. Doing this ahead of time ensures you have all necessary utilities up and running when you move in.

Settling into Your New Home

- Unpacking Strategically: Focus on unpacking essential items first, such as toiletries, clothes, and kitchen supplies. This helps you settle in quickly and makes the first few days more comfortable. Unpack room by room to keep the process organized and manageable.

- Deep Cleaning: Before unpacking, take the time to thoroughly clean your new home. This includes wiping down surfaces, cleaning the fridge and kitchen appliances, and scrubbing bathrooms. Cleaning from top to bottom ensures a fresh start in your new space.

- Changing Locks and Address: For security purposes, change the locks on all exterior doors. Update your address with the postal service, banks, and any subscriptions or services you use. This ensures your mail is forwarded to your new home and helps prevent any security issues.

What government programs are available for first-time home buyers in 2024?

Several government programs can assist first-time home buyers by providing financial support and incentives. Here are some key programs available in 2024:

FHA Loans

Federal Housing Administration (FHA) loans are designed to help first-time home buyers with lower credit scores and smaller down payments. FHA loans require a minimum down payment of 3.5% and have more lenient credit requirements compared to conventional loans. They are a popular choice for those who might not qualify for traditional financing.

VA Loans

The Department of Veterans Affairs (VA) offers loans to eligible veterans, active-duty service members, and certain members of the National Guard and Reserves. VA loans often require no down payment and have competitive interest rates. They also do not require private mortgage insurance (PMI), making them a cost-effective option for eligible buyers.

USDA Loans

The United States Department of Agriculture (USDA) provides loans to home buyers in rural areas through the Rural Development program. USDA loans require no down payment and offer low interest rates to eligible applicants. These loans are intended to promote homeownership in rural and suburban areas.

How to qualify for first-time home buyer grants and loans?

Qualifying for first-time home buyer grants and loans involves meeting specific criteria set by the program. Here are some general steps to help you qualify:

Understanding Eligibility Requirements

- Income Limits: Many first-time home buyer programs have income limits to ensure assistance goes to those who need it most. Check the specific income requirements for the programs you are interested in.

- Credit Score and Financial Health: While some programs like FHA loans have lenient credit requirements, maintaining a good credit score can help you secure better terms and lower interest rates. Ensure your credit report is accurate and work on improving your credit score if needed.

- First-Time Buyer Status: Some programs define a first-time home buyer as someone who hasn’t owned a home in the past three years. Verify your status to ensure you qualify for first-time buyer benefits.

Application Process

- Pre-Approval: Obtain a mortgage pre-approval to understand how much you can afford and demonstrate to sellers that you are a serious buyer. This involves submitting financial documents to a lender who will assess your eligibility.

- Documentation: Gather necessary documents such as proof of income, tax returns, bank statements, and identification. Each program will have specific documentation requirements, so be prepared to provide detailed financial information.

- Education Courses: Some programs require buyers to complete a home buyer education course. These courses cover the home buying process, budgeting, and maintaining your new home, ensuring you are well-prepared for homeownership.

What is the process for applying for a VA home loan as a first-time buyer?

Applying for a VA home loan involves several steps designed to ensure that veterans and active-duty service members can secure favorable mortgage terms. Here’s a breakdown of the process:

Step 1: Obtain a Certificate of Eligibility (COE)

The first step is to obtain a Certificate of Eligibility (COE). This document verifies your eligibility based on your military service history. You can request your COE online through the VA’s eBenefits portal, by mail, or directly through a VA-approved lender, who can often obtain it on your behalf quickly.

Step 2: Pre-Approval

Once you have your COE, you should seek pre-approval from a VA-approved lender. This involves providing financial information such as income, credit score, and employment history. Pre-approval gives you an idea of how much you can borrow and shows sellers that you are a serious buyer.

Step 3: House Hunting and Making an Offer

With pre-approval in hand, you can begin house hunting with a real estate agent who is familiar with VA loans. Once you find a home, your agent will help you make an offer. The offer should include a “VA escape clause,” allowing you to back out if the property doesn’t appraise for the agreed price.

Step 4: Appraisal and Underwriting

After your offer is accepted, your lender will order a VA appraisal to ensure the property meets minimum property requirements (MPRs) and is worth the purchase price. The appraisal process is critical as it protects both you and the lender. Concurrently, the underwriting process will verify all financial details and ensure you meet the loan requirements.

Step 5: Closing

Once the appraisal and underwriting are complete, you will receive a Closing Disclosure outlining the final terms of your loan. You will then attend a closing meeting to sign the necessary documents, pay any required closing costs, and officially take ownership of your new home .

How do USDA loans benefit first-time home buyers in rural areas?

USDA loans, provided by the United States Department of Agriculture, offer several benefits to first-time home buyers, particularly in rural areas:

No Down Payment

One of the most significant advantages of USDA loans is that they require no down payment. This can make homeownership more accessible for buyers who might struggle to save enough for a traditional down payment.

Competitive Interest Rates

USDA loans typically offer competitive interest rates that can be lower than those for conventional loans. These favorable rates help make monthly mortgage payments more affordable for first-time buyers.

Flexible Credit Requirements

USDA loans also feature more flexible credit requirements, making it easier for buyers with less-than-perfect credit scores to qualify. This flexibility can be particularly beneficial for first-time buyers who are still building their credit history.

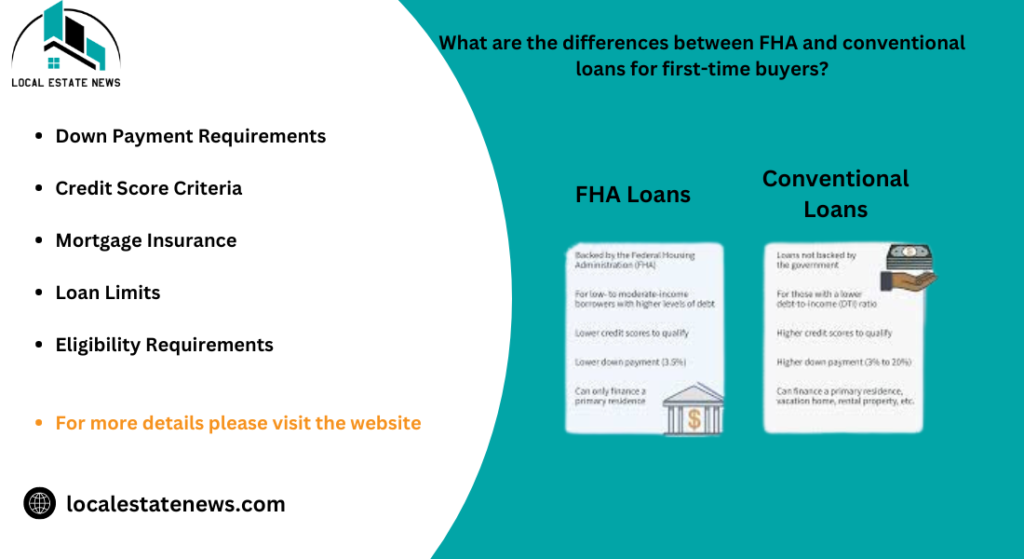

What are the differences between FHA and conventional loans for first-time buyers?

When choosing between FHA and conventional loans, first-time buyers should consider several key differences:

Down Payment Requirements

FHA loans require a lower down payment, typically as low as 3.5%, making them an attractive option for first-time buyers with limited savings. In contrast, conventional loans usually require a minimum down payment of 5% to 20% depending on the lender and borrowers credit profile.

Credit Score Requirements

FHA loans are known for their more lenient credit score requirements, often approving borrowers with scores as low as 580. Conventional loans generally require higher credit scores, typically 620 or above, to qualify for favorable terms.

Mortgage Insurance

FHA loans require both upfront and annual mortgage insurance premiums (MIP), which can increase the overall cost of the loan. Conventional loans, on the other hand, require private mortgage insurance (PMI) only if the down payment is less than 20%, and PMI can be canceled once the borrower reaches 20% equity in the home

These programs and loan types offer various benefits tailored to different needs, making homeownership accessible to a broader range of first-time buyers. Understanding these differences helps buyers choose the best financing option for their situation.

What is the Good Neighbor Next Door program and who qualifies?

The Good Neighbor Next Door (GNND) program is a federal initiative managed by the U.S. Department of Housing and Urban Development (HUD). It aims to improve community reessentialization by offering eligible participants the opportunity to purchase homes at a significant discount.

Benefits and How It Works

The GNND program provides eligible participants with a 50% discount off the list price of homes located in designated reEssentialization areas. These homes are typically foreclosed properties previously financed through FHA mortgages. After foreclosure, HUD owns these properties and offers them for sale through the GNND program to promote homeownership and community stability. To qualify for this discount, buyers must agree to live in the home as their sole residence for a minimum of three years.

Eligibility Requirements

To qualify for the GNND program, you must be a full-time:

- Law enforcement officer

- Pre-Kindergarten through 12th-grade teacher

- Firefighter

- Emergency medical technician (EMT)

You must also work in the area where the home is located and commit to continuing in your employment for at least one year after purchasing the home, you or your spouse must not have owned any home in the year before participating in the program and must not have previously bought a home through the GNND program.

Application Process

Interested buyers can search for available properties through the HUD Homestore website. The process involves:

- Searching for Homes: Identify available homes in reEssentialization areas by using the GNND link on the HUD Homestore website.

- Submitting an Interest: Follow specific property instructions to submit your interest in the home.

- Verification and Purchase: HUD will verify eligibility, and if you qualify, you can purchase the home at a discounted rate.

How do mortgage credit certificates (MCCs) help first-time home buyers?

Mortgage Credit Certificates (MCCs) are federal tax credits that can help first-time home buyers reduce the amount of federal income tax they owe, making homeownership more affordable mortgage calculator.

Benefits of MCCs

- Tax Credit: MCCs provide a direct tax credit that reduces the federal income taxes owed by the homeowner. This can be up to 20% of the annual mortgage interest paid.

- Increased Affordability: By reducing the tax burden, MCCs increase the home buyers disposable income, which can be used towards mortgage payments or other homeownership costs.

- Qualification for Larger Loans: The increased disposable income can help buyers qualify for larger mortgage loans, making it easier to purchase a home that meets their needs.

How to Qualify and Apply

To qualify for an MCC, you typically need to meet the following criteria:

- Be a first-time home buyer (not having owned a home in the last three years).

- Meet income and purchase price limits set by the local issuing agency.

- Use the home as your primary residence.

To apply, buyers should contact their state or local housing finance agency, which administers the MCC program. The agency will provide details on the application process, eligibility requirements, and any associated fees.

What are the most common mistakes first-time home buyers should avoid?

First-time home buyers often face a steep learning curve when navigating the home-buying process. Avoiding common pitfalls can save time, money, and stress.

Not Getting Pre-Approved for a Mortgage

Skipping pre-approval can lead to unrealistic expectations about what you can afford and may cause delays when you find the right home. Pre-approval helps you understand your budget and shows sellers that you are a serious buyer.

Overlooking Additional Costs

Many first-time buyers focus only on the down payment and mortgage payments, forgetting about other costs such as property taxes, homeowners insurance, maintenance, and closing costs. It is essential to budget for these expenses to avoid financial strain.

Skipping the Home Inspection

A home inspection is crucial to identify potential issues that might not be apparent during a casual viewing. Skipping this step can lead to unexpected repair costs and safety issues down the line. Always invest in a professional home inspection to ensure the property is in good condition.

By understanding and avoiding these common mistakes, first-time home buyers can make more informed decisions and enjoy a smoother path to homeownership.

What are the tax benefits for first-time home buyers?

First-time home buyers can take advantage of several tax benefits designed to make homeownership more affordable. These benefits can significantly reduce the overall cost of buying a home and provide ongoing savings.

Mortgage Interest Deduction

One of the most substantial tax benefits for homeowners is the mortgage interest deduction. Homeowners can deduct the interest paid on a mortgage of up to $750,000 for loans taken out after December 15, 2017. For loans acquired before this date, the limit is $1 million. This deduction can also apply to interest paid during the first month of mortgage payments, often included in closing costs.

Property Tax Deduction

Homeowners can also deduct property taxes paid on their primary residence. The Tax Cuts and Jobs Act of 2017 introduced a cap on the state and local tax (SALT) deduction, limiting it to $10,000 per year for single and married filers. This deduction encompasses property, state income, and local sales taxes, providing significant savings on annual tax returns.

Mortgage Insurance Premium Deduction

If you put down less than 20% on a conventional loan, you might pay private mortgage insurance (PMI). While mortgage insurance premiums were deductible in past years, the deductibility status can vary annually based on legislative changes. For now, if you meet certain income requirements, you may still be able to deduct these premiums.

What is the importance of homebuyer education courses for first-time buyers?

Homebuyer education courses are invaluable for first-time buyers, offering essential knowledge and confidence throughout the home-buying process.

Complete Understanding

These courses cover critical topics such as budgeting, mortgage options, and the home-buying process itself. By understanding these aspects, first-time buyers can make informed decisions, avoid common pitfalls, and manage their finances better, ensuring a smoother transition to homeownership).

Qualification for Assistance Programs

Many down payment assistance programs, grants, and special loan programs require completion of a homebuyer education course. This requirement ensures that buyers are well-prepared for the responsibilities of owning a home and are less likely to encounter financial difficulties in the future.

Improved Financial Management

Homebuyer education often includes advice on maintaining good credit, managing debt, and planning for future home maintenance costs. These skills are crucial for maintaining financial health and securing the long-term benefits of homeownership.

How can first-time home buyers find local down payment assistance programs?

Finding local down payment assistance programs can significantly reduce the financial burden of buying a first home.

Research State and Local Programs

Many states and local governments offer down payment assistance programs specifically for first-time home buyers. These programs can provide grants or low-interest loans to cover down payment and closing costs. Start by visiting your states housing finance agency website or local government housing office to explore available options.

HUD Resources

The U.S. Department of Housing and Urban Development (HUD) provides resources and links to various down payment assistance programs across the country. Their website can guide you to programs that might be available in your area and explain the eligibility requirements and application process.

Nonprofit Organizations

Nonprofits like NeighborWorks America and local community development corporations often offer down payment assistance. These organizations can provide both financial assistance and educational resources to help first-time buyers navigate the home-buying process successfully.

By utilizing these resources and programs, first-time home buyers can make the transition to homeownership more affordable and accessible.

How To Buy a House?

Starting on the journey of buying your first home is an exciting milestone, but it comes with its own set of challenges and responsibilities. By understanding the various aspects of home buying, from financial preparation and mortgage options to the benefits of homebuyer education and local assistance programs, first-time buyers can make informed decisions and secure their dream homes with confidence. how to buy a house Fully guided.

First-time home buyers should start with a thorough assessment of their financial health, ensuring they are well-prepared for the costs associated with homeownership. Programs like VA and USDA loans, as well as the Good Neighbor Next Door program, provide significant benefits, including no down payment options and substantial discounts, making homeownership more accessible, tax benefits such as mortgage interest deductions and property tax deductions can further reduce the financial burden of owning a home.

Education is crucial in this process. Homebuyer education courses not only provide essential knowledge but also increase the likelihood of qualifying for assistance programs. These courses cover everything from budgeting to the intricacies of the mortgage process, ensuring buyers are well-prepared for the responsibilities of homeownership.

In conclusion, becoming a first-time home buyer involves careful planning and a solid understanding of the various resources and programs available. By leveraging these tools and staying informed, first-time buyers can navigate the home buying process effectively, ensuring a smooth transition into their new home and setting a strong foundation for their future.