Property taxes are a crucial component of homeownership, impacting everything from monthly mortgage payments to the overall cost of maintaining real estate. These taxes, levied by local governments, are based on the assessed value of your property and the local tax rate. How property taxes work, how they are calculated, and the factors that influence them is essential for homeowners and real estate investors alike. This article delves into the intricacies of property taxes, providing insights into how you can manage and potentially reduce your tax obligations.

- Property tax assessment

- Real estate taxes

- Local tax rate

- Tax exemptions

- Property value

- Mortgage impact

What Are Property Taxes and How Are They Calculated?

Property taxes are local taxes that homeowners pay based on the value of their property, including the land and any structures on it. These taxes are a primary source of revenue for local governments, funding public services like schools, emergency services, and infrastructure. The amount you pay in property taxes is determined by two main factors: the assessed value of your property and the local tax rate.

- Assessed Value: The assessed value is an estimate of your property’s worth, determined by a local government assessor. This value can be influenced by factors, sale prices of comparable properties, the condition of the property, and any improvements or renovations. It’s important to note that the assessed value is often a percentage of the market value, depending on local regulations.

- Local Tax Rate: Also known as the millage rate, this is the amount of tax payable per dollar of the assessed value of a property. It is determined by local government entities, counties, municipalities, and school districts, and is used to meet budgetary requirements. For example, if your home is assessed at $250,000 and the local tax rate is 2%, your annual property tax bill would be $5,000.

What Are the Different Types of Property Taxes?

Property taxes can vary widely depending on the type of property and its use. The main types of property taxes include:

- Residential Property Taxes: These are taxes levied on homes where people live. The tax rate and assessed value can differ depending on the local jurisdiction, the home’s value, and whether it is a primary residence. Some areas offer exemptions or reductions for primary residences, the homestead exemption.

- Commercial Property Taxes: These taxes apply to properties used for business purposes, including retail stores, office buildings, and industrial sites. Commercial properties often have higher tax rates compared to residential properties because they are valued higher and generate income for the owners

- Personal Property Taxes: In some jurisdictions, personal property taxes are levied on movable assets like vehicles, machinery, and equipment. These taxes are more common in commercial contexts but can also apply to personal items like cars and boats in certain states.

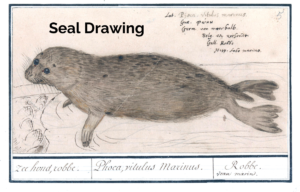

How Do Property Tax Rates Vary by State and Municipality?

Property tax rates can vary significantly across different states and municipalities due to varying local laws, budgetary needs, and assessment practices. For example:

- State Differences: States like New Jersey and Illinois are known for having some of the highest property tax rates in the country, driven by the need to fund public services schools and infrastructure. Conversely, states like Hawaii and Alabama have some of the lowest rates, often due to lower overall state budgets and different funding structures.

- Municipality Variations: Within a state, property tax rates can also vary from one municipality to another. For instance, urban areas might have higher rates due to the higher cost of public services and infrastructure maintenance, while rural areas might have lower rates. Additionally, some cities might impose additional taxes or fees to cover specific local services, further increasing the overall tax burden for homeowners.

What Factors Influence Property Tax Assessments?

Property tax assessments are determined by a variety of factors that local assessors use to estimate the value of your property. These factors can significantly impact how much you pay in property taxes each year:

- Market Value: The most important factor influencing your property tax assessment is the market value of your property. This is determined by recent sales of comparable properties in your area, also known as “comps.” If home prices in your neighborhood are rising, it’s likely that your assessed value and therefore your property taxes will increase as well

- Property Improvements: Any improvements or renovations to your property, adding a new room, upgrading the kitchen, or installing a swimming pool, can increase the assessed value. Local assessors take these enhancements into account because they generally raise the market value of the property. It is important to consider how these improvements might impact your tax bill before undertaking major projects.

- Location and Neighborhood: The location of your property also plays a crucial role. Properties in desirable neighborhoods, with good schools, low crime rates, and proximity to amenities, tend to have higher assessments, properties in areas with declining property values or those that lack essential services may see lower assessments.

How Can You Appeal Your Property Tax Assessment?

If you believe your property tax assessment is too high, you have the right to appeal it. The process involves several steps:

- Review Your Assessment Notice: The first step is to carefully review the assessment notice you receive from your local tax authority. This document will detail the assessed value of your property and the amount of taxes due. Make sure to compare this with the market value of similar properties in your area. If there are significant discrepancies, it may be worth appealing.

- Gather Evidence: To strengthen your appeal, gather evidence that supports your claim that the assessment is too high. This could include recent sales data for similar properties, a professional appraisal, or evidence of property defects or issues that might lower the value. Document any factors that might justify a reduction in your property’s assessed value

- File the Appeal: Submit your appeal to the local assessor’s office or board of review within the designated time frame usually within 30 to 60 days of receiving your assessment notice. Be sure to follow all local procedures, including filling out the necessary forms and submitting your evidence. If the appeal is successful, your property taxes will be adjusted accordingly.

What Are the Best Strategies to Lower Your Property Taxes?

Reducing your property taxes can save you a significant amount of money over time. Here are some effective strategies:

- Apply for Exemptions: Many localities offer property tax exemptions for certain homeowners, senior citizens, veterans, or those with disabilities. The most common exemption is the homestead exemption, which reduces the taxable value of your primary residence. Check with your local tax authority to see what exemptions you might qualify for and how to apply.

- Challenge Your Assessment: As mentioned, if you believe your property is overvalued, you can challenge the assessment. Make sure to research comparable properties and present your case to the assessor. Even a small reduction in your assessed value can lead to significant tax savings.

- Limit Home Improvements: Before making any major renovations or additions to your property, consider how they might affect your tax bill. Some improvements can significantly increase your property’s assessed value, leading to higher taxes. If keeping your tax bill low is a priority, focus on maintenance rather than large-scale upgrades

How Do Property Taxes Impact Your Mortgage Payments?

Property taxes are an integral part of your monthly mortgage payment. If you have an escrow account, your mortgage payment includes not just the principal and interest but also an estimated amount for property taxes and homeowners insurance. The lender collects these additional payments and deposits them into an escrow account, from which they pay your property taxes when they are due. This setup helps ensure that you don’t have to worry about making a large lump-sum tax payment each year, as the costs are spread out over 12 months. You can check Free Mortgage calculations.

Fluctuations in property tax rates or assessed property values can lead to changes in your monthly mortgage payment. For instance, if your local government reassesses your property and determines that its value has increased, your property taxes and consequently your monthly mortgage payment will likely go up. Conversely, if you qualify for property tax exemptions, your tax burden could decrease, potentially lowering your monthly payments.

What Property Tax Exemptions and Relief Programs Are Available?

Many homeowners may qualify for property tax exemptions or relief programs, which can significantly reduce their tax burden. Common exemptions include the homestead exemption, which lowers the taxable value of your primary residence, and exemptions for seniors, veterans, and individuals with disabilities. These exemptions can vary widely depending on your state or local municipality, so it’s essential to check with your local tax authority to see what you might qualify for

To exemptions, some states and localities offer property tax relief programs designed to help low-income homeowners, particularly the elderly or those on a fixed income. These programs might provide direct tax credits, deferments, or reductions based on your financial situation. Applying for these programs typically involves submitting specific documentation and meeting eligibility requirements.

How Do Property Taxes Affect Real Estate Investment Returns?

Property taxes can have a significant impact on real estate investment returns. Higher property taxes reduce the net income from rental properties, which can lower the overall return on investment (ROI). For investors, it is crucial to consider the local property tax rates when evaluating potential investments, as these taxes can vary significantly from one region to another. Higher taxes can also make properties less attractive to potential buyers, affecting resale values and long-term capital gains.

changes in property tax laws or rates can introduce an element of uncertainty into real estate investments. Investors need to stay informed about local government policies and any proposed changes that might affect property taxes, as these can directly influence both current cash flow and future profitability.

What Are the Latest Trends in Property Taxes for 2024?

In 2024, property taxes are being influenced by several emerging trends, many of which are tied to broader economic and societal shifts. Most notable trend is the impact of rising home values on property tax assessments. As property values increase, so do property tax bills, as local governments adjust assessments to reflect the higher market values. This trend is particularly evident in areas experiencing a real estate boom, where homeowners are seeing significant increases in their annual tax obligations.

Trend is the growing complexity of property tax relief programs. As property taxes rise, many states and localities are expanding or modifying relief programs to help homeowners manage their tax burdens. These programs often include exemptions for seniors, veterans, and low-income homeowners, but the eligibility criteria and benefits can vary widely depending on the location. Homeowners are encouraged to stay informed about these programs to ensure they are taking full advantage of any available tax relief.

How Do Changes in Property Value Influence Your Tax Obligations?

Changes in property value directly influence your tax obligations because property taxes are calculated as a percentage of your properties assessed value. When your property value increases, whether due to market conditions or improvements you have made, your assessed value and therefore your tax bill will likely rise as well. This can be a double-edged sword; while a higher property value increases your home equity, it also means higher taxes, which can impact your monthly budget and long-term financial planning.

If property values decline, you might expect your property taxes to decrease, this isn’t always the case, as local governments might increase tax rates to compensate for a lower tax base, especially if they rely heavily on property taxes for revenue. Therefore, it’s important for homeowners to keep track of both market trends and local government decisions to anticipate changes in their tax obligations.

What Is the Impact of Local Government Policies on Property Taxes?

Local government policies have a significant impact on property taxes, particularly through decisions related to budget allocations and tax rate adjustments. In 2024, many local governments are grappling with the need to fund public services and infrastructure improvements, which can lead to higher property taxes. For instance, if a local government decides to increase spending on schools, roads, or public safety, they might raise property tax rates to generate the necessary revenue.

Some states are implementing or considering caps on property tax increases to protect homeowners from sharp spikes in their tax bills. These policies can provide relief in areas where property values are rapidly increasing, but they also limit the revenue that local governments can generate, potentially leading to cuts in public services or the need for alternative revenue sources

How Can You Plan for Future Property Tax Increases?

Planning for future property tax increases is essential for homeowners, especially in areas where property values are rising or local governments are expanding their budgets. One effective strategy is to regularly monitor your properties assessed value. Since property taxes are based on this value, staying informed about any changes can help you anticipate increases. If you notice a significant rise in your assessment, it might be a good time to budget for higher tax payments or even challenge the assessment if you believe it is inaccurate.

Approach is to take advantage of property tax relief programs. Many states offer homestead exemptions, senior citizen discounts, or income-based reductions that can mitigate the impact of tax increases. By applying for these exemptions early and ensuring you meet the eligibility criteria each year, you can reduce the financial burden of rising property taxes..

Consider building a reserve fund specifically for property taxes. By setting aside a small amount each month, you can create a financial cushion that will make it easier to handle tax increases when they occur. This proactive approach can help prevent financial strain and ensure that you’re prepared for any changes in your tax obligations.

What Are the Legal Limits on Property Taxes, and How Do They Work?

Legal limits on property taxes are mechanisms designed to prevent excessive tax burdens on homeowners. These limits, often referred to as “tax caps,” vary by state and municipality but generally restrict how much property tax rates or assessed values can increase annually. For example, California’s Proposition 13 limits the annual increase in assessed value to 2% unless the property changes ownership, which helps keep tax bills more predictable.

Legal limit is the homestead exemption, which reduces the taxable value of a primary residence. This exemption provides significant tax relief for homeowners, particularly in states with high property tax rates. Some states also have “circuit breaker” programs that cap property taxes as a percentage of a homeowner’s income, providing additional protection for lower-income residents.

These legal limits are essential for preventing rapid increases in property taxes that could force homeowners out of their properties, they also have the side effect of limiting local government revenue, which can lead to budget constraints and reduced public services.

How Do Property Taxes Differ Between Residential and Commercial Properties?

Property taxes for residential and commercial properties differ significantly, primarily in how they are assessed and the rates applied. Residential properties are usually taxed based on their market value, with various exemptions available to reduce the taxable amount, homestead exemptions. The tax rates for residential properties are typically lower than those for commercial properties, reflecting the different uses and income potential of these property types.

Commercial properties, on the other hand, are often subject to higher tax rates because they generate income and have a higher assessed value. The assessment process for commercial properties can also be more complex, involving income-based valuation methods in addition to market value assessments. This complexity is due to the diverse nature of commercial properties, which can range from small retail spaces to large industrial facilities.

Commercial property owners may have fewer opportunities to reduce their tax burden through exemptions compared to residential property owners. They can sometimes appeal assessments or seek tax incentives designed to encourage business development, tax abatements or credits for specific improvements.

What Are the Differences Between State and Local Property Taxes?

State and local property taxes differ primarily in terms of their application and the entities that levy them. Local governments, cities, counties, and school districts, primarily levy property taxes on real property, which includes land and buildings. These taxes are a major source of revenue for local governments, funding essential public services like schools, law enforcement, and infrastructure maintenance, state governments have a more limited role in property taxation, often focusing on personal property taxes (e.g., on business equipment) rather than on real property, the extent of state involvement can vary widely, with some states imposing additional property tax rates or offering statewide property tax relief programs.

What Are Legal Strategies for Reducing Property Taxes?

There are several legal strategies that both residential and commercial property owners can use to reduce their property taxes. These include:

- Appealing Your Property Assessment: If you believe your property has been overvalued, you can file an appeal with your local assessment board. Providing evidence, recent sales data of comparable properties or an independent appraisal, can support your case for a lower assessment.

- Applying for Exemptions: Many jurisdictions offer tax exemptions for certain categories of property owners, including veterans, senior citizens, and those who use their property for agricultural purposes. These exemptions can significantly reduce your taxable value and, consequently, your tax bill.

- Engaging a Property Tax Consultant: For commercial properties, in particular, hiring a property tax consultant can be beneficial. These professionals can navigate complex tax regulations, assist in filing appeals, and identify other opportunities for tax savings..

How Do Commercial and Residential Property Taxes Differ?

Commercial and residential property taxes differ significantly in their calculation and rates. Residential property taxes are typically based on the market value of the property, with rates designed to encourage homeownership. On the other hand, commercial properties are often assessed using methods that consider both the property’s market value and its income-generating potential. This generally results in higher tax rates for commercial properties, reflecting their greater contribution to local public services and infrastructure wear and tear. Additionally, commercial property owners may have fewer exemptions available compared to residential property owners, which can further increase their tax burden.

What Is the Final Takeaway on Property Taxes?

Property taxes are a complex but essential aspect of property ownership, influencing everything from monthly mortgage payments to long-term financial planning. The nuances between state and local property taxes, as well as the differences between residential and commercial property assessments, is crucial for both homeowners and investors. Legal strategies appealing assessments and applying for exemptions can provide significant tax relief, helping to mitigate the financial burden of property taxes. Now you can know details Real estate trends

property values continue to rise and government policies evolve, staying informed about property tax trends and potential increases is more important than ever. Utilizing available tax reduction strategies, property owners can better manage their finances and avoid unexpected tax hikes, a proactive approach to understanding and managing property taxes can lead to substantial savings and a more secure financial future